In this article, we’ll cover the crypto benefits in the context of payment gateway for high-risk businesses.

Whether buying the latest gadget or booking a flight, chances are you’ve encountered a payment gateway without realizing it. But what exactly is a payment gateway?

Think of it as a virtual bridge securely connecting your customers’ payment information to your bank account. It’s like a digital cash register handling the transaction process, ensuring your customers’ payments are managed smoothly and securely.

Convenient, right?

However, not all enterprises find selecting a suitable payment gateway easy. High-risk enterprises, a unique category of entrepreneurs, face unusual challenges when searching for a suitable crypto payment processor.

Introducing High-Risk Businesses and Their Distinctive Challenges

High-risk companies operate in industries deemed, well, high risk. The assigned label highlights various factors, such as the potential for chargebacks, the industry’s reputation or even legal and regulatory considerations. Examples of high-risk industries include online gaming, adult entertainment, iGaming and more.

What sets these businesses apart is the difficulty of finding a payment gateway accepting their high-risk merchant account. Traditional payment processors often shy away from these industries, avoiding the high-risk category. Often, high-risk merchants find themselves in a bind, struggling to accept online crypto payments and grow their ventures.

Platforms like Soar Payments usually offer high-risk merchant accounts for these businesses. Such payment solutions focus on helping these businesses abandoned by institutions like banks.

Highlighting the Growing Popularity of Cryptocurrencies

But fear not because here’s where cryptocurrencies come to the rescue! Over the past decade, cryptocurrencies, such as Bitcoin and Ethereum, have become increasingly popular. These digital currencies offer a decentralized and secure way to conduct transactions, making them an attractive option for high-risk businesses.

While traditional payment gateways may turn their backs on high-risk businesses opting for low-risk merchant accounts, cryptocurrencies welcome them with open virtual arms. These businesses can tap into numerous benefits by leveraging a crypto payment gateway.

Instead of relying solely on credit card payments, they can explore digital currencies and conveniently accept payments. But how does it work? Well, it’s simple.

- High-risk firms can integrate a crypto payment gateway into their existing systems, allowing them to accept online payments in crypto. Customers who hold these digital assets can make purchases without traditional banking channels.

- Moreover, selling crypto through normal exchanges (or over-the-counter trading platform) is an avenue to diversify revenue streams.

In the next sections, we’ll delve deeper into the benefits of crypto payment gateways for high-risk enterprises. From increased payment options to enhanced security and privacy, cryptocurrencies offer advantages empowering these firms to thrive in the high-risk landscape.

Let’s embark on this crypto journey!

Crypto Payment Gateways and their Features

So, what makes a crypto payment gateway a game-changer for high-risk industries?

Accept Online Payments with Ease

Whether you run a Forex trading site or an iGaming platform, a crypto payment gateway opens the doors to more growth opportunities. Unlike traditional merchant account providers that shy away from these businesses, crypto gateways embrace them, empowering them to cater to their customers’ needs.

Robust Security and Fraud Prevention

Cryptocurrencies use blockchain technology, ensuring secure and transparent transactions. This gives businesses and customers peace of mind, knowing their sensitive information and funds are protected. The immutable nature of blockchain ensures no chargebacks and fraud, saving high-risk companies from potential losses.

Simplified Payment Processing

It eliminates unnecessary intermediaries, such as banks, resulting in faster transactions and settlements. Say goodbye to long waiting periods for funds to be deposited into your merchant account. With a crypto gateway, you can experience near-instant settlements, enabling you to manage your cash flow more efficiently.

Low Transaction Fees

Reducing operation costs can translate into substantial savings for businesses, allowing them to allocate resources to other critical aspects of their operations.

Crypto payment gateway platforms offer a lifeline to high-risk firms by providing them with a secure, efficient and cost-effective payment processing solution. They break down the barriers traditional merchant account providers impose and encourage high-risk firms to thrive in their respective industries.

So, how do high-risk merchants succeed when using crypto payment gateways?

Crypto Payments Benefits to High-Risk Merchants

Crypto payment processing solutions create the following possibilities:

Increased Options with Crypto Payment Gateway for High-Risk Businesses

Embracing cryptocurrencies means expanding your payment options, giving customers more flexibility to transact with your high-risk merchant account. By providing a diverse range of cryptocurrencies, you cater to a broader customer base, which can lead to increased sales and customer satisfaction.

What’s great about receiving different cryptocurrencies is the flexibility it offers. Instead of being restricted to one payment channel, you can accept many digital currencies based on your customers’ preferences.

Global Reach and Accessibility

Crypto transactions transcend geographical barriers, allowing high-risk merchant accounts to receive payments globally. Traditional payment methods often have restrictions and limitations, especially with cross-border transactions. Crypto payments processors allow you to reach customers global customers, expanding your market reach and potentially increasing your sales.

Accessibility is another crucial advantage for the high-risk merchant. Anyone with an internet connection and a digital wallet can pay with crypto, and this inclusivity opens doors for customers who may not have access to traditional banking services.

The nature of crypto and its associated privacy also makes it suitable for a high-risk business. Merchants could attract crypto-holding clients by embracing cryptocurrency payments.

Instant Deposits to Your High-Risk Merchant Account

Crypto transactions are known for their efficiency and speed. Unlike traditional methods involving many intermediaries and lengthy verification processes, crypto payment processing is quick, making them suitable for high-risk merchant accounts. Instant execution means faster transactions, satisfied customers and improved overall payment processing efficiency.

Additionally, crypto offers the potential for near-instant payments. High-risk accounts require rapid transaction settlement due to the critical nature of these businesses. Crypto payments can happen almost instantly, giving high-risk merchants quick access to funds and helping them manage cash flow more effectively.

Transaction Costs Won’t Worry You

With a high-risk merchant account, you’ll want to reduce your expenditure wherever possible. Crypto gateways may offer more competitive pricing than traditional high-risk merchant services with high transaction fees and payment processing costs. You will reduce your business costs, saving more funds to expand your business.

Did you know? Cryptocurrency gateway services like CoinPayments charge an industry-low transaction fee starting at just 0.5%. Such cost-effective terms ensure you spend less and earn more from accepting crypto payments.

Enhanced Security with Crypto Payment Gateway for High-Risk Businesses

Is your merchant account secure?

High-risk merchant accounts often handle large transaction volumes because of the business operations. With such huge sums, the owners must be concerned about the security and safety of their assets.

Cryptocurrencies add another layer of security to high-risk merchant accounts. The technology behind crypto and its transactions is blockchain, which uses enhanced cryptographic security or a series of security layers to protect data within its network. Additionally, blockchain records data with a tamper-proof mechanism to protect user information.

With this kind of security, your merchant accounts in a crypto payment processor will give you peace of mind knowing your assets are safe.

High-Level Privacy Protecting High-Risk Merchant Accounts

Privacy is another advantage crypto payments can guarantee a high-risk merchant account. Traditional payment methods share sensitive customer information during the transaction process, which raises privacy concerns. However, with crypto gateways, transactions remain protected from prying eyes, your business’s high-risk merchant account.

No Chargebacks and Fraud

As a high-risk merchant, it’s tough to protect your business from chargebacks and fraudulent activities causing headaches. So, how does crypto help in all this? Transaction immutability.

It becomes virtually impossible for clients to claim chargebacks fraudulently once they pay using crypto. Your merchant account becomes protected from potential losses with blockchain security measures.

With high-risk operations, it’s unsurprising for clients to dispute various charges. Solving these misunderstandings can be lengthy and cumbersome; however, with blockchain, transaction details are transparently available, making it easier to investigate and resolve disputes efficiently. This streamlined dispute resolution process can save you time, money and resources.

Linking a Dedicated Gateway with Your Merchant Account

Now that you understand the benefits of accepting cryptocurrencies, let’s delve into how you can implement a crypto payment gateway for high-risk businesses.

Don’t worry. It’s not as complicated as it may seem! Just follow these simple steps, and you’ll be on your way to embracing the world of crypto payments.

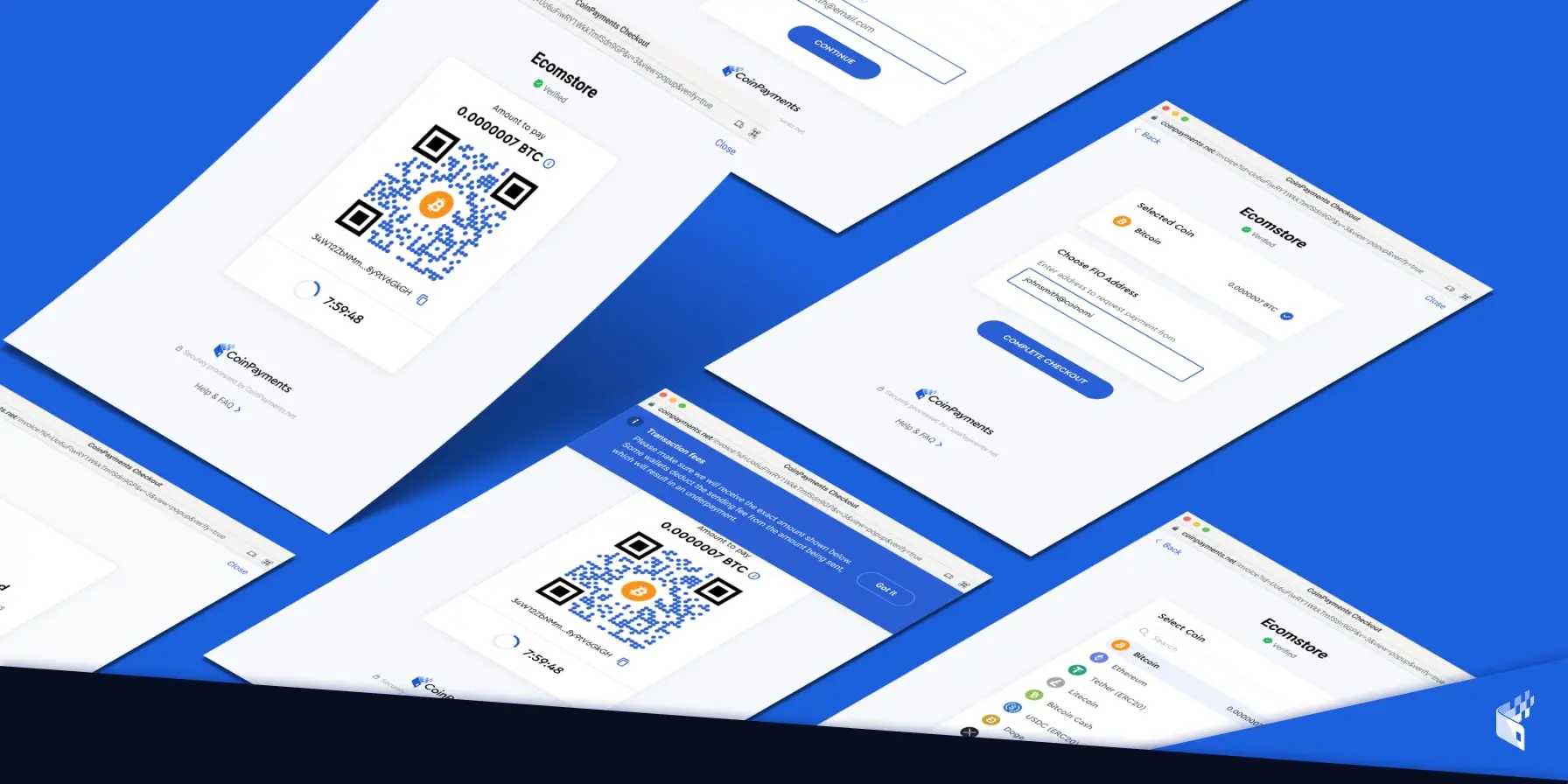

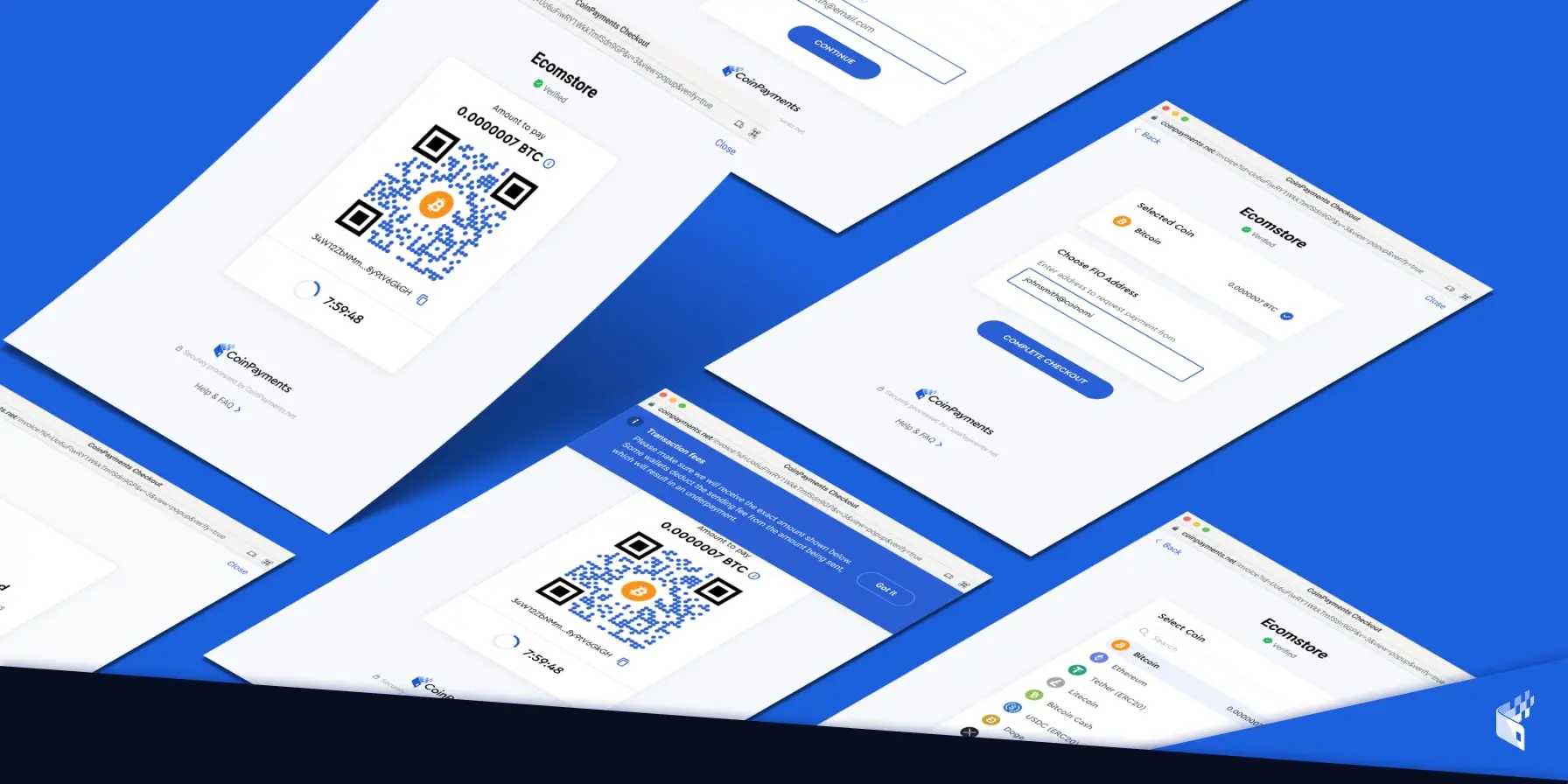

The Integration Process

The first step in implementing a crypto gateway is finding a reliable and reputable provider specializing in the high-risk merchant account type. Since your business falls into the high-risk category, work with a gateway service with an understanding of your unique situation.

Once you’ve chosen a gateway provider, the integration process usually involves a few straightforward steps. The provider will guide you through the process and provide the tools and documentation. It typically includes:

Account Setup

You’ll need to create a merchant account with the gateway provider. This account will serve as the central hub for all your crypto transactions.

Verification

As part of the setup process, the provider will require documentation to verify your business and its legitimacy (Know Your Business or KYB). This may include identification documents, proof of address and processing history. Don’t worry; it’s a standard procedure to ensure compliance and security.

Integration

The gateway service will provide APIs (Application Programming Interfaces) or plugins to integrate into your website or e-commerce platform. These APIs facilitate the smooth integration of the gateway into your existing infrastructure.

Selecting Reliable High-Risk Merchant Services

Choosing the right gateway provider is crucial for the success of your crypto payment integration. Consider platforms with experience working with a high-risk merchant account similar to yours. Read customer reviews, compare pricing structures and evaluate their security measures.

Transparency and clear communication are vital when selecting a provider. Ensure they have responsive customer support to address any concerns or issues that may arise during the integration process.

Tips for Managing Crypto Payments Effectively

As you accept crypto payments, here are tips to help you manage them effectively:

Stay Updated

Cryptocurrency markets are dynamic, so you must stay informed about the latest trends and developments. Keep an eye on market fluctuations and adjust your pricing strategies accordingly.

Diversify Your Cryptocurrency Portfolio

Accepting multiple cryptocurrencies can broaden your customer base. Consider popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC) to cater to a broad customer base.

Security Measures

Implement robust security measures to safeguard your crypto transactions. Utilize multi-factor authentication for your merchant account, encrypt sensitive customer data and regularly update your website’s security protocols.

By embracing cryptocurrency payments, your business stays ahead of technological advancements in finance. Feel free to use our steps and tips for a streamlined experience.

High-Risk, High-Reward

Accepting cryptocurrencies through a crypto gateway can bring a multitude of benefits. Let’s recap why crypto could be the fuel your business needs.

- Embracing crypto expands your payment options. With an array of cryptocurrencies available, you can cater to the diverse preferences of your customers.

- You can reach customers from all corners of the globe. Gone are the days of being limited by geographical barriers. The world becomes your marketplace, and with it comes the potential for increased sales and exponential growth.

- Now, let’s talk about money. Every business owner understands the importance of managing costs effectively. Crypto payments come with lower transaction fees compared to traditional payment processing providers.

- Security is paramount, especially for the high-risk merchant account. Crypto offers enhanced security measures through its cryptographic features.

Don’t be afraid to dive into the world of high-risk merchant services and discover its many opportunities.

A Merchant Account Provider You Can Rely On

Since 2013, CoinPayments has handled high payments volume for various high-risk industries, including online entertainment and iGaming. As crypto merchant account providers, CoinPayments delivers a reliable and tailored experience to help businesses considered high risk grow.

Trusted by thousands of businesses and individuals since 2013, you can consider CoinPayments a crypto payment gateway for high-risk businesses.

Do you want to see your high-risk enterprise thrive?

Start the integration process by creating an account on our website. Embrace crypto payments with CoinPayments and watch your high-risks turn to high-rewards!