Whether you’re considering buying altcoins or simply curious about what sets them apart, this altcoins explained article is your gateway to understanding cryptocurrencies beyond Bitcoin.

Bitcoin’s groundbreaking arrival in 2009 marked more than just the birth of a new form of currency; it laid the foundation for a new world of digital assets known as cryptocurrencies.

While Bitcoin remains a household name, it’s far from the only player in the game. The crypto markets have expanded, and now there are literally thousands of alternative digital currencies, aptly named “altcoins.”

These altcoins, from Ethereum to Litecoin, have emerged with unique features, improvements, and aspirations. Some aim to revolutionize how we handle personal finance, while others focus on faster transactions or enhanced security.

In this post, we’ll unravel the intriguing world of altcoins. We’ll explore what they are, how they compare to Bitcoin, and why they might just be the next big thing in the ever-evolving landscape of digital currencies.

Altcoins Explained: What is an Altcoin, Anyway?

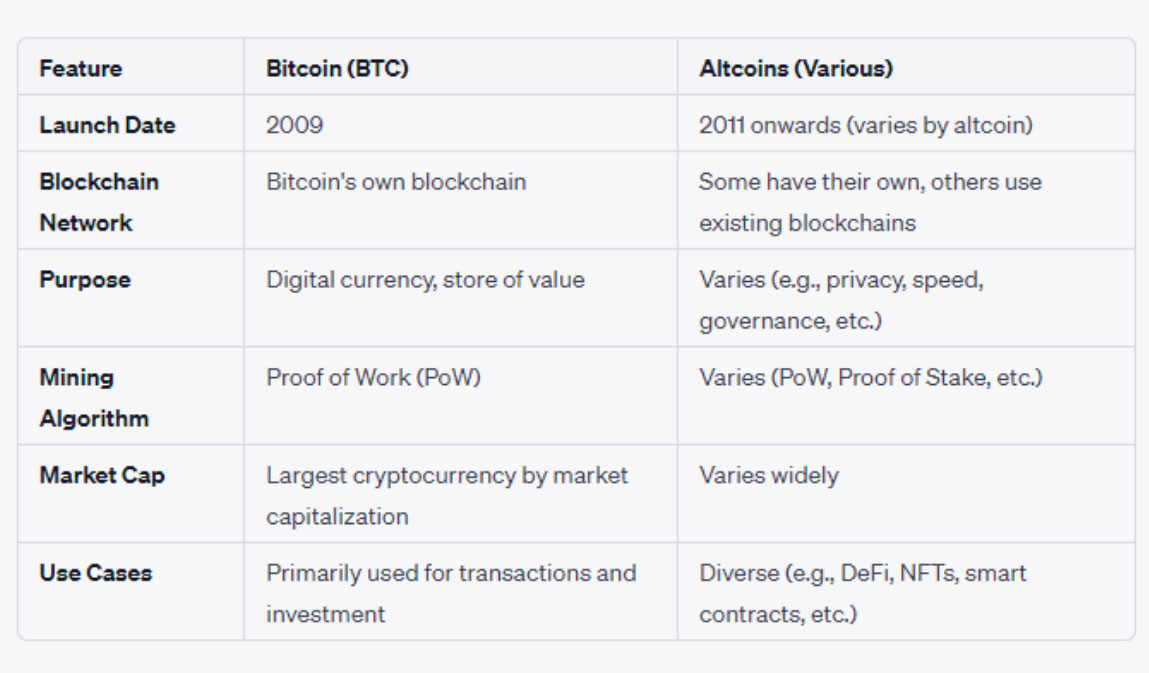

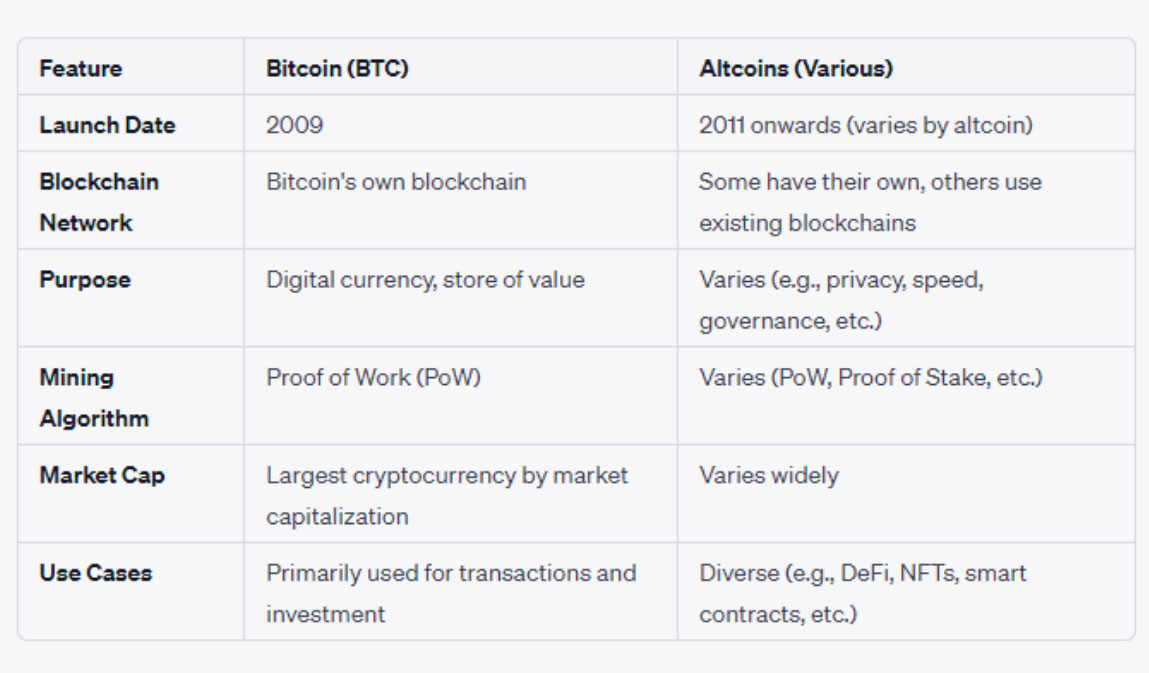

You’ve probably heard the term “altcoin” tossed around in crypto conversations, but what exactly is an altcoin? Altcoins are the alternative cryptocurrencies that emerged after Bitcoin’s success. They’re called “altcoins” because they present an alternative to Bitcoin, the first and largest cryptocurrency.

What Makes an Altcoin?

An altcoin is any digital currency other than Bitcoin. While Bitcoin has established itself as the pioneer in the blockchain network, many altcoins have been created to offer different features, benefits, and uses. Some focus on enhanced privacy, others on lower transaction fees, and some even aim to be more energy-efficient.

Fun Fact: Namecoin was the first altcoin and a pioneer in domain name security, making internet censorship more difficult.

At the time of writing, Bitcoin currently makes up around 46.86% of the total crypto market cap, meaning more than half of the crypto market’s value comprises altcoins. Today, blockchains can run hundreds of “altcoins,” fueling similar currency projects with unique rules and mechanisms. Altcoins like Ethereum provide developers with a toolkit and programming language to build decentralized applications on the blockchain.

What Do Altcoins Have in Common?

When diving into the world of altcoins, it’s natural to wonder what these diverse digital assets have in common. While each altcoin may have unique features and purposes, some underlying similarities bind them.

Operating on Blockchain Technology

To understand what altcoins have in common, it’s essential to grasp how blockchain technology works. The blockchain network is a distributed ledger that stores data like cryptocurrency transactions, decentralized finance (DeFi) smart contracts, and more.

This network is groundbreaking because it’s a decentralized, trustless, P2P payment network that functions without a central authority.

Most altcoins, like Bitcoin, operate using this blockchain technology. They utilize the “chain” comprising “blocks” of data to verify new data before additional blocks can be added to the ledger.

Serving as Cryptocurrencies

Many altcoins are not that different from Bitcoin and offer unique features such as different distribution methods or mining algorithms.

Yet, most altcoins also function as cryptocurrencies to serve as a store of value and for handling decentralized peer-to-peer payments. They may offer higher transaction speeds, privacy, or other specific advantages.

Further Reading: How to Buy Altcoins in 2023: A Comprehensive Guide

Improving and Innovating

While altcoins share the foundational principles of blockchain technology with Bitcoin, some have emerged to improve on Bitcoin’s flaws or achieve other goals.

For example, Litecoin, known as the “lite version of Bitcoin,” was designed to offer faster transactions.

Diverse Use Cases

Some altcoins have been developed for very narrowly defined use cases, diverging from Bitcoin’s original purpose as a peer-to-peer payment network.

Whether it’s enhancing privacy, reducing transaction fees, or implementing new consensus mechanisms, altcoins continue to innovate and expand the possibilities of blockchain technology.

Types of Altcoins Explained

With the rise of cryptocurrencies, the landscape has become rich and diverse, offering many options for investors and enthusiasts alike. Altcoins, in particular, have evolved into various types, each serving a unique purpose and function within the crypto market. Here are the main categories of altcoins you’ll encounter:

Coins

Coins are independent cryptocurrencies that operate on their own blockchain. They operate on their own network and are often created to serve as a medium of exchange, store of value, or unit of account. Examples include Ethereum, which offers faster transactions, and Bitcoin Cash coin, an offshoot of the Bitcoin network.

Tokens

Tokens are digital assets built on an existing blockchain, such as the Ethereum network. Unlike coins, they don’t have their own blockchain but leverage the underlying technology of the host blockchain. Tokens can represent anything from physical goods to access to services, and they often play a role in decentralized applications (dApps).

Stablecoins

Stablecoins are a type of cryptocurrency designed to minimize volatility by being pegged to a stable asset like the USD or gold. They provide a safe haven during turbulent market conditions and are often used in trading pairs on decentralized exchanges. Examples include USD Coin (USDC) and Tether (USDT).

Further Reading: How Do Stablecoins Work and What Are They?

Forks

Forks are variations of an existing cryptocurrency that are modified or upgraded. They can be either “hard forks,” resulting in a new separate currency, or “soft forks,” implementing changes without creating a new coin. Forks often occur to improve features, fix vulnerabilities, or implement new consensus mechanisms. Some popular examples are Bitcoin Cash coin and Litecoin.

Other Types

Security Tokens

Security tokens are tokenized assets offered on stock markets. They represent the transfer of value from an asset, such as real estate or stocks, to a token. For this to work, the asset must be secured and held. Security tokens are regulated as they are designed to act as securities.

Utility Tokens

Utility tokens are used to provide services within a network, such as purchasing services, paying transaction fees, or redeeming rewards. Ether (ETH), used in the Ethereum blockchain to pay for transactions, and Filecoin, used to buy storage space, are examples of utility tokens.

Meme Coins

Meme coins are inspired by jokes or silly takes on other well-known crypto assets. They often gain popularity quickly, driven by online hype and speculation. Many refer to the sharp run-up in these types of altcoins during April and May 2021 as “meme coin season.”

Governance Tokens

Governance tokens allow holders certain rights within a blockchain, such as voting for changes to protocols or having a say in the decisions of a decentralized autonomous organization (DAO). They are generally native to a private blockchain and used for blockchain purposes, but they have become accepted as a separate type because of their unique purpose.

Store Your Altcoins in the CoinPayments Crypto Wallet

With the diverse world of altcoins at your fingertips, you might wonder how to securely manage and store these digital assets. Whether you’re exploring one type of altcoin or diversifying across several, having a reliable and user-friendly wallet is crucial. When it comes to managing your altcoins, security, and convenience are paramount.

That’s where the CoinPayments Crypto Wallet comes into play. With thousands of users and support for over 2,000 cryptocurrencies, CoinPayments offers a one-stop solution for holding, converting, and purchasing gift cards with your crypto assets.

Further Reading: Best Crypto Wallet for Business: What You Need to Know

One Wallet, Multiple Coins

The CoinPayments Multi-Coin Wallet allows you to hold a vast array of cryptocurrencies all in one place. Whether you’re a seasoned crypto enthusiast or a newcomer to the digital currency space, managing your altcoins has never been more straightforward.

Auto Coin Conversion

Worried about market volatility? CoinPayments offers an Auto Coin Conversion feature that helps you avoid sudden price changes by automatically converting your coins. It’s a smart way to keep your investments stable and secure.

Global Payments for Businesses

If you’re a business owner looking to accept crypto payments, CoinPayments provides global payment solutions that are borderless, instant, and come with low transaction fees. It’s a modern approach to expanding your business reach and embracing the future of finance.

Set Up Your Free Wallet with CoinPayments