If you’ve been keeping an eye on the financial markets, you’ve probably noticed a seismic shift happening. We’re talking about the rise of digital assets and cryptocurrencies and how they’re challenging traditional banking systems.

Now, you might be wondering, “What’s all this buzz about banks vs crypto?” Well, let’s dive into it. The global financial system, as we know it, is undergoing a transformation. Financial institutions that have been pillars of our economy are now sharing the stage with digital assets like Bitcoin.

In the past few years, we’ve seen a surge in interest in the crypto market. From major banks and asset managers to fintech startups, various entities are exploring the potential of this new form of financial service. But why? What makes digital assets so appealing?

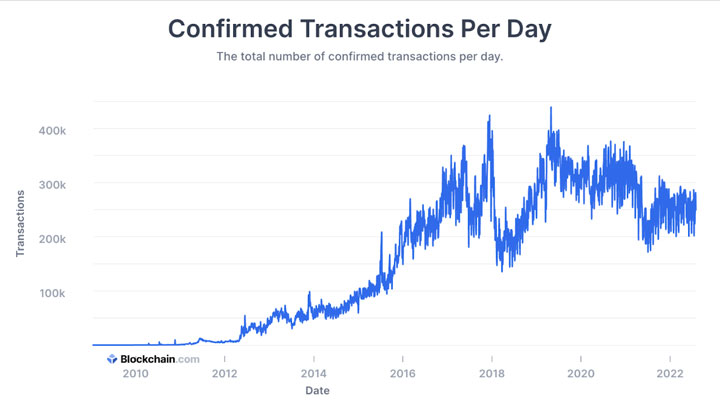

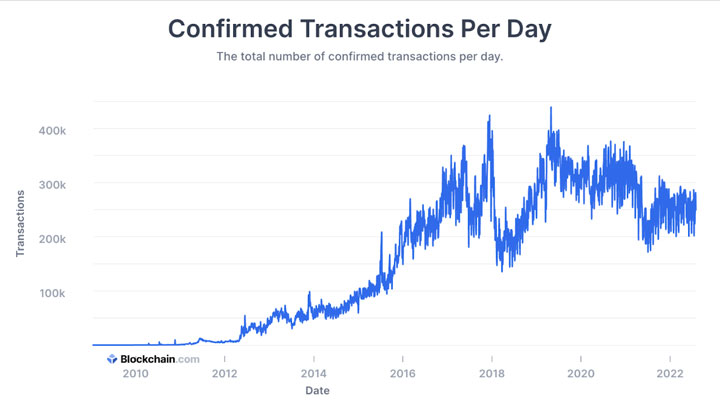

The answer lies in the efficiency and speed of crypto transactions and its underlying technology, blockchain. Unlike traditional banking systems, which can take days to process transactions, digital currencies can do it almost instantly. Plus, they offer a very secure way of transferring ownership of assets, thanks to blockchain technology.

But it’s not just about speed and security. The decentralized nature of blockchain is also a game-changer. It means that you don’t need a central bank or a financial institution to verify transactions. Everything is done on the blockchain, reducing the need for too many human interactions and lowering asset exchange fees.

So, are we witnessing the dawn of a new era in the financial system? Will cryptocurrencies replace traditional banks? Or is there a middle ground where both can coexist and thrive? Let’s explore these questions and more in this blog post.

Banks vs Crypto

These two systems are currently vying for dominance: the traditional banks we’ve known and used for decades and the relatively new but rapidly growing digital currencies.

Backed by financial institutions and central banks, the banking system has been the backbone of our economy for centuries. They provide various services, from facilitating payments and processing transactions to offering financial services like loans and credit.

However, these financial services depend heavily on human interactions, which can lead to inefficiencies and delays. Plus, they’re usually bound by geographical limitations and banking hours, which can restrict accessibility.

On the other hand, digital money, also known as cryptocurrencies, operates on a decentralized system like blockchain technology. This means they’re not controlled by any central bank or government, offering a level of freedom and flexibility not seen in traditional banking. Decentralized transactions are verified by a network of computers worldwide, making them fast and efficient.

Additionally, cryptocurrencies can be accessed and used anytime, anywhere, offering a level of convenience that’s hard to beat.

But it’s not just about convenience. Crypto also offer a very secure way of transferring assets. Thanks to the blockchain technology they operate on, every crypto transaction is recorded and cannot be altered or deleted.

Moreover, the decentralized nature of cryptocurrencies reduces the need for intermediaries, which can lower asset exchange fees. This is a significant advantage for users, especially those involved in cross-border transactions who often have to deal with high exchange rate fees imposed by banks.

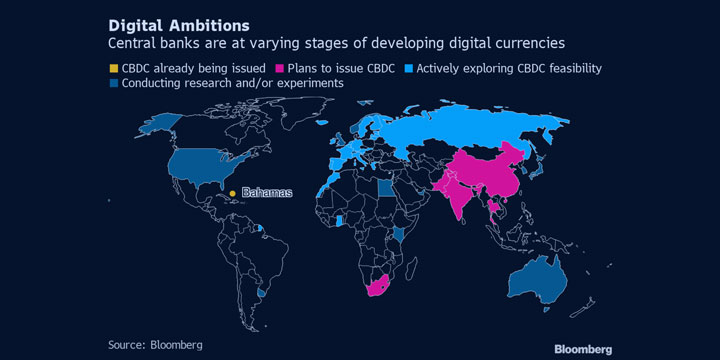

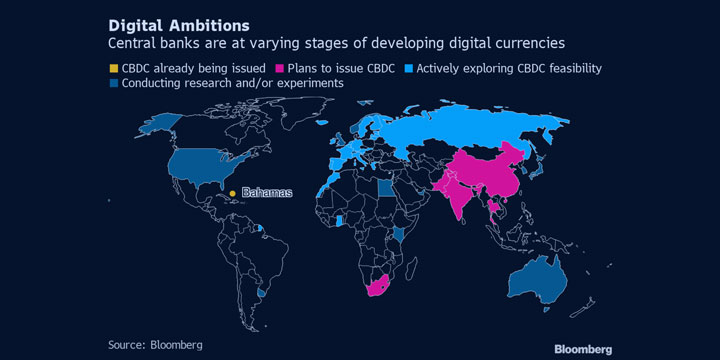

In recent years, we’ve seen a surge in the adoption of crypto. Major banks, financial institutions, asset managers, and even some governments are exploring the potential of these digital assets. For instance, several central banks worldwide are considering introducing their own digital currencies, known as Central Bank Digital Currencies (CBDCs). This move could potentially bridge the gap between traditional banking and the crypto space, offering users the best of both worlds.

However, it’s important to note that while crypto offers numerous advantages, it also comes with its own set of challenges. These include price volatility, regulatory issues, and concerns about privacy and security. Therefore, it’s crucial for users to understand these aspects before diving into the world of digital currency.

How Crypto Improves Drawbacks of Traditional Banking Systems

Ever been frustrated by the limitations of current financial systems? You’re not alone. In fact, these very frustrations sparked the creation of a whole new kind of currency; cryptocurrencies. They offer a host of advantages over traditional banking systems, addressing many of the drawbacks that have long plagued the financial industry. Here’s how:

Accessibility and Reliability

The banking industry can be unreliable, especially when their servers are down. This can restrict access to your finances unless you physically withdraw money. Cryptocurrencies never go out of service. They are accessible anytime, anywhere, offering a level of convenience that’s hard to beat.

Lower Fees

Banking institutions are notorious for their high fees, from overdraft charges to transaction fees. In 2019, banks made over $15 billion in overdraft fees alone, according to the Federal Consumer Financial Protection Bureau. Cryptocurrencies, however, don’t charge exorbitant fees. The most common fees are gas fees, which are rewards given to miners for validating transactions on the blockchain.

Fast Transactions

With traditional bank, transactions can take a long time, especially for large amounts or international payments. It can take a week or more, which can be problematic in time-sensitive situations. Cryptocurrencies offer extremely fast transactions.

Unlike traditional banking, which have queues and protocols to follow, bitcoin transactions are processed almost instantly, providing a much-needed solution for urgent financial needs.

No Human Bias

Traditional banking can be subject to human biases. For instance, a financial service issuing officer can deliberately delay transactions or even freeze your assets. Cryptocurrencies, being decentralized, minimize human interactions and are free from such biases.

Data Security

Banks collect sensitive information like passport or ID information, SSN, residence address, and employment information. This data can be shared with third parties, posing a risk to your privacy.

Purchases show who you are, what you like and more information about you. Information that can be shared with or stolen by 3rd parties.

With cryptocurrencies, payment, deposits and transactions can swiftly be made without any of your info out there, offering a higher level of privacy.

Challenger Banks vs Crypto Institutions

Financial institutions that operate entirely online, like Revolut, are known as challenger banks and they pose a challenge to the conventional banking sector. They offer a seamless onboarding process and efficient banking experience, often requiring just a few simple steps to open an account.

Features such as real-time transaction alerts, budgeting mechanisms, and reward programs make managing finances a more enjoyable experience for consumers. Moreover, they facilitate worldwide interbank financial communication, making cross-border transactions more efficient.

Crypto institutions are making significant strides in disrupting the traditional system. Institutions like CoinPayments, Coinbase and Binance offer many of the same benefits as challenger banks, but with additional features that come with the use of blockchain technology. They provide greater security, faster transaction times, and a range of financial products comparable to traditional banks.

Furthermore, some of them offer extended services like decentralized governance mechanisms, staking, and decentralized finance (DeFi) liquidity provision, empowering users to effectively “become their own bank.”

Interestingly, there’s an overlap between these two systems. For instance, Revolut, a leading challenger bank, has integrated cryptocurrency trading into its product offering, enabling users to buy, sell, and hold digital assets. On the other hand, some crypto institutions like Coinbase operate on a centralized platform, but they’re also expanding into DeFi, demonstrating their adoption of newer technologies.

Looking towards the future, the convergence of these two systems presents an exciting opportunity for the emergence of better financial innovation: crypto banking. By incorporating the user-friendly interfaces of a challenger bank with the transactional infrastructure of blockchain, crypto-powered financial services have the potential to change the way consumers manage their finances.

This could be particularly beneficial for individuals who do not meet the strict requirements of traditional banks or those in developing countries where traditional banks charge high fees and offer limited financial services.

What is Crypto Banking?

Crypto banking, a term that’s been gaining traction in the financial world, is a fascinating blend of the user-friendly interfaces of challenger banks and the robust transactional infrastructure of blockchain technology. This innovative approach to financial services has the potential to revolutionize how we manage our finances.

Imagine a world where not only the banked population but also those who face hurdles with the traditional banking system or have no access to it at all – the unbanked – can benefit from a financial service that caters to their needs. This is where crypto banking shines.

In many developing countries, traditional banks often impose high fees and offer limited financial services. For these demographics, a crypto bank could be a game-changer, providing a more affordable and comprehensive financial service. This could be a lifeline for individuals who don’t meet the stringent requirements of traditional banks, such as the need for a high credit score or substantial collateral.

But the advantages of crypto banking don’t stop there. One of the most significant benefits it offers is the speed and security of borderless payments and transactions. This is particularly important for those who rely on remittances payments.

According to the World Economic Forum, global remittances were estimated to be a whopping $800 billion in 2022. These remittances play a crucial role in the economies of low and middle-income countries. In this context, the faster and more secure transactions offered by crypto banks could provide a significant advantage.

In essence, crypto banking is not just about financial inclusion; it’s about providing a better, more efficient, and more secure financial service. It’s about leveraging the power of blockchain technology to create a financial system that is accessible, affordable, and beneficial for everyone.

The Future of Transactions: Crypto or Banks?

The future of transactions is not a binary choice between crypto or banks. Instead, it’s a dynamic landscape where both these entities coexist and evolve. With their decentralized nature, cryptocurrencies offer a new way of transacting that’s fast, anonymous, and free from the control of traditional banks. They have the potential to democratize the entire financial system, especially in regions where access to banking services is limited.

However, cryptocurrencies are not without their challenges. Their volatility, the energy-intensive mining process, and their use in illicit activities are significant concerns. Moreover, the lack of a central authority can sometimes lead to issues related to trust and security.

On the other hand, central banks around the world are exploring the concept of Central Bank Digital Currencies (CBDCs). These digital currencies combine the benefits of cryptocurrencies, such as speed and ease of transactions, with the stability and trust associated with traditional banks. CBDCs could potentially offer a more regulated and secure form of digital currency, addressing some of the challenges associated with cryptocurrencies.

In the end, the future of transactions might not be a matter of crypto vs. banks, but rather a hybrid model that incorporates the strengths of both. As we move forward, the key will be to balance innovation with regulation, ensuring that the evolution of our financial systems serves the best interests of all stakeholders.

As the world of finance continues to evolve, platforms like CoinPayments are at the forefront of this revolution, facilitating easy and secure cryptocurrency transactions. With the increasing global adoption of cryptocurrencies, businesses worldwide are starting to accept crypto payments and deposits, making platforms like CoinPayments increasingly relevant in the financial landscape.

Final Thought

The rise of digital assets and the increasing adoption of blockchain technology are pushing the boundaries of what’s possible in the financial world. From facilitating payments to processing securities transactions, the potential applications of these technologies are vast and varied.

Digital currencies, with their decentralized nature and the security and transparency offered by blockchain technology, present a compelling alternative to traditional banking systems. However, it’s important to remember that this doesn’t spell the end for banks. Instead, it opens up new avenues for innovation and collaboration.

So, the question isn’t whether crypto will replace banks or vice versa. The real question is how these two systems will adapt and evolve to serve the changing needs of businesses and consumers worldwide. As we move forward, it’s clear that the future of transactions lies in the integration of the old and the new, the traditional and the digital, the banks and the crypto.

CoinPayments: A Gateway to Crypto Payments

As a global crypto payment gateway, CoinPayments is making crypto transactions easy and accessible for everyone. Trusted by thousands of businesses and individuals since 2013, CoinPayments offers real-time payments with industry-low processing fees of only 0.5%.

Whether you’re a business owner looking to accept crypto payments or an individual user wanting to manage your crypto assets efficiently, CoinPayments is here to meet your needs. It’s paving the way for the future of transactions, where traditional banking systems and digital currencies coexist and thrive.

Learn more about how CoinPayments can serve you.