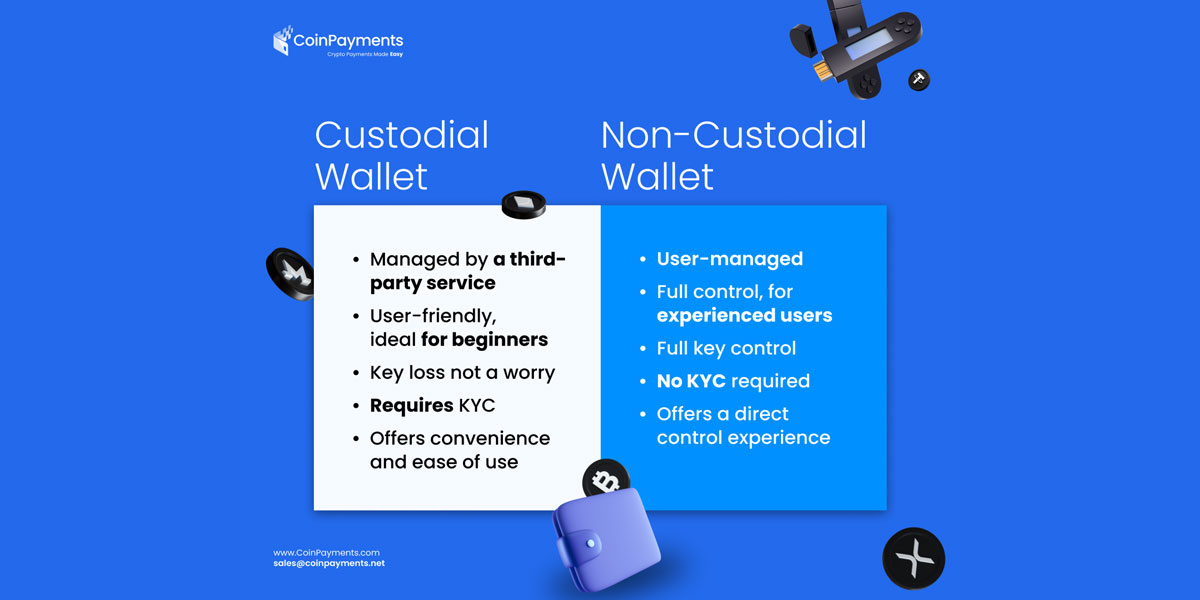

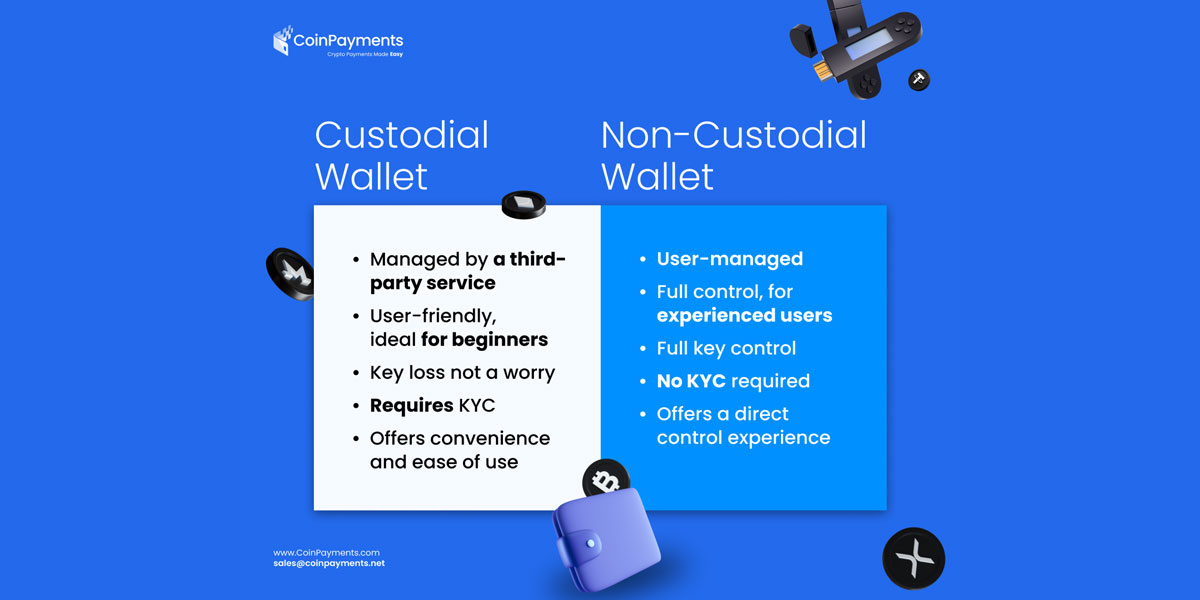

The world of cryptocurrency is growing, and if you’re reading this, you’re likely eager to join the action. But hold on a minute – before you start, there’s a critical decision you need to make; choosing the right crypto wallet. When it comes to storing your digital assets, you have two main options – custodial and non-custodial wallets.

Custodial wallets are a bit like your traditional bank account. You’re essentially entrusting a third party with your private keys and, by extension, your crypto assets. Sure, it’s convenient, but it also comes with its own set of risks. The safety of that option depends on how secure the third party is.

Conversely, non-custodial wallets give you complete control over your private keys and digital assets. It’s like being your own bank, but with that freedom comes responsibility. You’re in charge of keeping everything secure, which can be intimidating if you’re new to crypto.

This article will explore the best non-custodial wallets available, covering hardware and software options. Whether you’re a seasoned trader or a crypto newbie, you’ll find valuable insights on choosing the best option to store and manage your digital assets securely.

What Is a Non-Custodial Crypto Wallet?

A non-custodial crypto wallet is like your personal vault for digital assets, and you’re the only one with the key. Unlike custodial wallets, where a third-party service holds your private keys, non-custodial crypto wallets give you complete control over your crypto assets and private keys.

Now, you might wonder, “What are these private keys?” They’re cryptographic codes that grant you access to your digital assets. When you set up a non-custodial wallet, these keys are generated and stored locally on your device, be it a computer or mobile app. This local storage adds an extra layer of security, making it harder for anyone but you to access your funds.

“Okay, but what if I lose my device?” you ask. That’s where the seed phrase comes in. It’s a series of words that act as a backup to restore your private keys. Store this phrase somewhere safe and offline; it’s your lifeline if things go south.

When you’re ready to make a transaction, your non-custodial wallet uses these private keys to digitally sign it, giving you the green light to proceed. This process is direct, secure, and doesn’t involve any middlemen. It’s financial freedom in its purest form, aligning perfectly with the decentralised ethos of blockchain.

But remember, with great power comes great responsibility. You’re the sole guardian of your private keys and seed phrase. Lose them; there’s no “Forgot Password?” link to save the day. So, take your security seriously. Use strong passwords, keep backups, and protect your device from prying eyes.

Types of Non-Custodial Wallets

There are generally three types of non-custodial wallets to choose from: software, hardware, and paper wallets. Each has its own set of pros and cons, and the best one for you depends on your needs. Let’s break it down:

Non-Custodial Software Wallets

Software wallets or hot wallets are apps or web portals you can access from your computer or mobile device. With this kind of wallet, your private keys are stored online (within the mobile app or computer that is always connected to the internet), making them easy to access but also a target for digital hacks.

Popular picks in this category include MetaMask, Trust Wallet, and Coinbase Wallet. They’re user-friendly and great for those who are always on the move but want to keep tabs on their crypto.

Non-Custodial Hardware Wallets

Hardware wallets or cold wallets are physical devices that store your private keys offline, away from the prying eyes of hackers. They are like portable USB sticks you plug into your computer when you need to make a transaction.

Ledger is a popular hardware wallet, with models like the Nano X and Nano S Plus. These wallets are a solid choice if you’re looking for that extra layer of security.

Paper Wallets

Paper wallets are an additional level of security to keep your keys safe. Your private keys and QR codes are printed on a piece of paper, and you’ll need another crypto wallet app that can scan the QR code to access your assets.

The downside? Paper isn’t exactly known for its durability, so handle it with care.

How to Choose the Right Non-Custodial Wallet

So, you’ve got a bit of understanding of the types of non-custodial wallets. Now comes the million-dollar question: “How do I pick the right non-custodial wallet?” Well, it’s not just eeny, meeny, miny, moe; some key factors must be considered. Let’s dive in:

User Interface

You don’t want to be fumbling around when dealing with your hard-earned crypto. The wallet should offer an intuitive, user-friendly experience that makes navigating, executing transactions, and accessing various features easy.

Security Features

When you go with a non-custodial wallet, you’re the captain of your ship, meaning you’re responsible for keeping your treasure safe. Look for wallets that offer tight security features like two-factor authentication (2FA), biometric login, multi-signature support, and encryption of your private keys.

Supported Cryptocurrencies

Whether you’re all-in on Bitcoin or diversifying with altcoins, ensure the wallet supports the cryptocurrencies you own or plan to own.

Customer Support

Last but not least, don’t underestimate the value of good customer support. Even though you control your funds, knowing you can contact a helpful team if you hit a snag or have questions is reassuring.

Best Non-Custodial Software Wallets

MetaMask

MetaMask is a household name in the crypto community. Launched in 2016, this wallet has amassed a user base of over 30 million crypto enthusiasts. It’s available as a mobile app for iOS and Android and as a browser extension compatible with Chrome, Firefox, Edge, and Brave.

MetaMask is a type of “hot wallet,” meaning it’s always connected to the internet. Like any self-respecting non-custodial wallet, MetaMask is secured by a password or PIN. Upon setup, you’ll also receive a 12-word passphrase, essentially your key to your assets. Keep this passphrase safe; you’ll need it if you ever forget your password or switch devices.

Crypto Compatibility

While MetaMask doesn’t roll out the red carpet for Bitcoin, it’s compatible with Ethereum and ERC20 tokens. Additionally, you can manually add networks like Arbitrum, Polygon, Binance Smart Chain, Optimism, and Avalanche.

Features

Downloading MetaMask is free, and so is receiving cryptocurrencies. Regarding transfers, you’ll only be charged the standard GAS fees – no hidden markups. MetaMask offers a ‘Portfolio’ feature for easy asset management and access to staking features. And if you’re into token swaps, MetaMask charges a modest 0.875% fee built into the exchange rate.

The Drawback

MetaMask isn’t a one-size-fits-all solution. It lacks support for popular cryptocurrencies like Bitcoin, XRP, Solana, and Cardano. Also, while it does support other networks, you’ll have to add them manually.

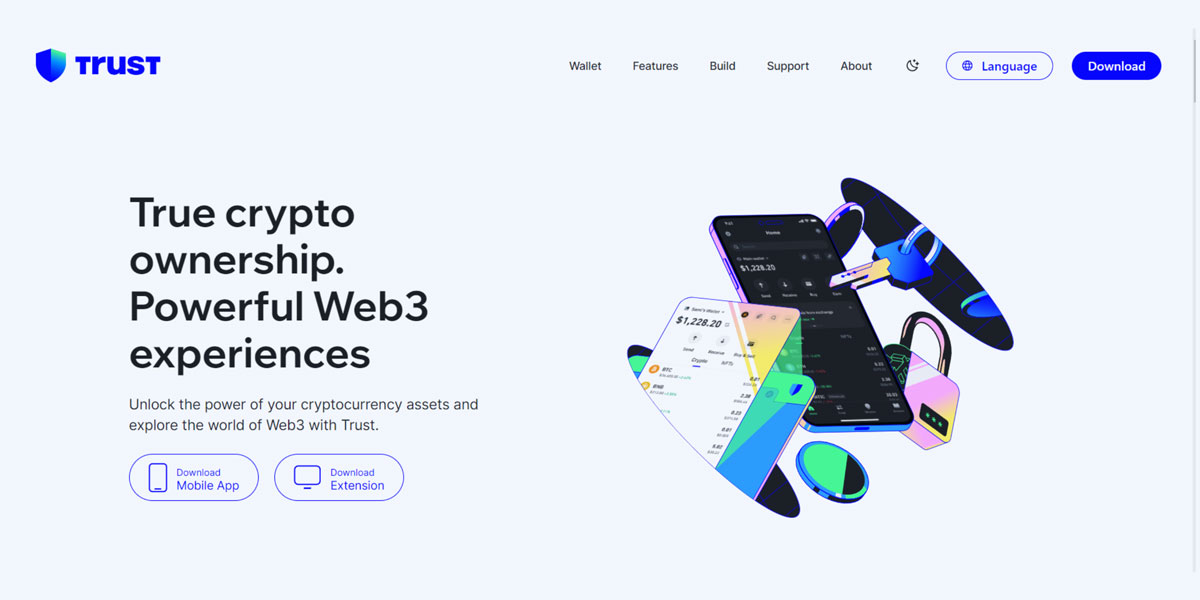

Trust Wallet

Trust Wallet is one of the best non-custodial crypto wallets today, supporting an impressive range of 9 million digital assets and over 70 blockchains; from Bitcoin and Ethereum to the rising blockchain solutions like Solana and Cardano.

Crypto Compatibility

Trust Wallet is more than just a crypto wallet; it’s a comprehensive digital asset manager. It’s especially handy for NFT collectors, making it a top pick for diversified portfolios. The wallet is a mobile app for iOS and Android devices, and it also offers browser extensions for Chrome, Brave, Opera, and Edge browsers.

Features

Setting up the Trust Wallet mobile app is straightforward. Choose a password or PIN, and you’re good to go. You’ll also receive a 12-word seed phrase, and for those who prioritise security, you can opt for a 24-word passphrase.

Trust Wallet is a gateway to the decentralised world, offering seamless access to popular dApps like UniSwap, PancakeSwap, and Compound among numerous options. It also includes a dApp browser and supports WalletConnect, allowing users to connect to dApps via a QR code. When it comes to fees, Trust Wallet is transparent. There are no hidden charges; you’ll only pay the standard GAS fees for transfers.

Additionally, you can deposit crypto directly from your Binance exchange account to your wallet via Binance Pay.

The Drawback

Trust Wallet isn’t without its limitations. Customer support can be slow, and the wallet currently lacks browser extensions for Firefox. Additionally, if you use a debit or credit card for crypto purchases, be prepared for higher fees.

Coinbase Wallet

Coinbase has been a trusted name in the crypto exchange landscape for years, and its Coinbase Wallet is no exception. Designed as a non-custodial software wallet, it gives you full control over your digital assets, ensuring your private keys are stored securely on your mobile device.

Crypto Compatibility

Coinbase Wallet is a non-custodial mobile wallet that supports a wide range of digital assets, including all ERC-20 tokens on the Ethereum network. It also extends support to EVM-compatible chains like Avalanche and Polygon. If you’re into stablecoins, you’ll be pleased to know that favorites like USDT, DAI, and USDC are all supported.

When it comes to security, Coinbase Wallet doesn’t cut corners. It employs Secure Enclave Technology specifically designed for storing private keys. Additional layers of security include 2FA via Google Authenticator, SMS authentication, and phone number verification. These features collectively provide a secure environment for your funds and access credentials.

Features

Coinbase Wallet offers many features, including ETH, ATOM, ADA, and SOL staking options. It also facilitates the transfer, storage, and receipt of NFTs. The wallet even has a browser-based dApp version and offers crypto lending facilities. Plus, it keeps you updated with market news and trending tokens.

The Drawback

While Coinbase Wallet is feature-rich, it’s not without its downsides. The user interface can be cluttered, making it challenging for crypto newcomers to navigate. Surprisingly, despite being a product of a well-known crypto exchange, it lacks support for the Bitcoin Cash network and XRP.

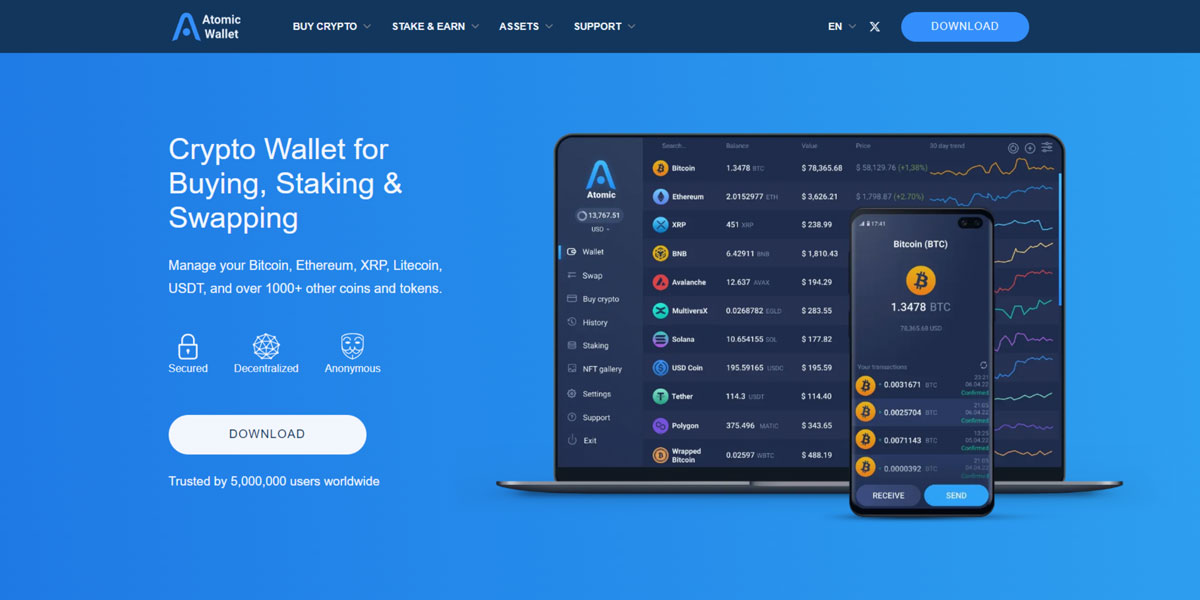

Atomic Wallet

Atomic Wallet has carved a niche as a decentralised, non-custodial wallet supporting many cryptocurrencies and networks. Available on desktop and mobile platforms, including iOS and Android, Atomic Wallet is a versatile tool for crypto enthusiasts.

Crypto Compatibility

Atomic Wallet is a host platform for over 500 cryptocurrencies, making it one of the most versatile non-custodial wallets out there. Whether you’re dealing with Bitcoin, Ethereum, or any other digital asset, this wallet has got you covered.

Don’t let its seemingly old-school approach to security fool you; Atomic Wallet is robust in its protective measures. Users are required to log in with a password, and multiple layers of security are in place. Account recovery is also straightforward, thanks to a 12-word backup seed phrase provided during user registration.

Features

What sets Atomic Wallet apart are its additional features. It offers staking options for 15 different coins, including ATOM, ETH, and SOL. The wallet also provides a 1% cashback on every exchange and purchase made through the app. Plus, it offers real-time cryptocurrency and digital asset price charts aggregated from various online resources.

The Drawback

The only notable downside to Atomic Wallet is its lack of support for hardware wallets, which might be a deal-breaker for some security-conscious users.

Best Non-Custodial Hardware Wallets

Non-custodial crypto hardware wallets are the gold standard for safeguarding your digital assets. Their isolated nature keeps them far removed from the vulnerabilities of connected devices, offering an extra layer of security. Let’s explore some of the best options out there.

Ledger

Ledger is a beacon of advanced security features and a user-friendly interface amongst the best non-custodial wallets out there today. With over 4 million hardware wallets sold, Ledger has cemented its reputation as a trusted name in the crypto world.

Why Choose Ledger?

- Multi-Platform Compatibility: Whether you’re using a mobile device or a desktop, Ledger’s hardware wallets are designed to work seamlessly across various platforms. This hardware device ensures you can manage your crypto assets wherever you are, offering a level of hardware wallet compatibility that’s hard to match.

- Offline Storage: One of the most compelling features of Ledger is its ability to securely store your cryptocurrencies in cold storage, isolated from the vulnerabilities of online hacks and malicious attacks. This makes Ledger a secure, non-custodial wallet that prioritises your asset’s safety.

- Extensive Asset Support: With Ledger, you’re not limited to just a handful of coins and tokens. The wallet supports over 5,500 crypto assets, making it one of the most versatile options for portfolio management.

- Unified Application: Ledger offers a unified application where you can not only store but also buy and sell crypto assets. This eliminates the need for multiple apps and streamlines the user experience.

Ledger Models

- Ledger Nano X: Priced at $149, the Nano X stands out for its Bluetooth connectivity, allowing for mobile management of your crypto assets. It supports over 5,000 different crypto assets and offers a user-friendly OLED display.

- Ledger Nano S Plus: A budget-friendly option at $79, the Nano S Plus supports the same extensive range of over 5,000 crypto assets but lacks Bluetooth connectivity. It offers a straightforward, user-friendly interface.

- Ledger Stax: The premium choice at $397, the Stax comes with Bluetooth connectivity and a unique curved E Ink touchscreen. It supports over 5,000 crypto assets and you can personalise the lock screen with your favorite NFT or photo, making it uniquely yours, setting it apart as a future-forward wallet.

The Drawbacks

While Ledger offers a robust set of features, it’s essential to note that you’ll need to purchase a Ledger hardware device to utilise these features. The cost can vary depending on the specific model and its capabilities. Additionally, since it’s a physical device, you’ll need to prevent device loss or damage.

By offering a blend of advanced security, extensive asset support, and user-friendly features, Ledger hardware wallets prove to be a top choice for anyone looking to invest in a non-custodial hardware wallet.

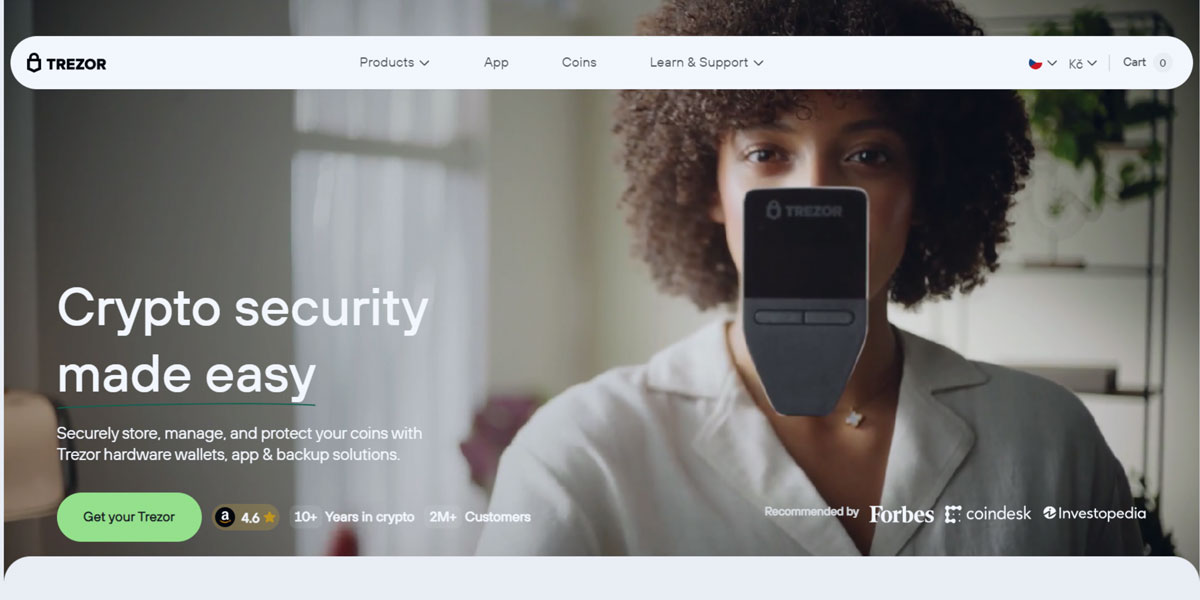

Trezor

Trezor is another name that’s synonymous with security and a user-friendly interface. As a pioneer in the hardware crypto wallet market, Trezor has set the standard for secure cryptocurrency management.

Why Choose Trezor?

- First Hardware Crypto Wallet: Trezor holds the distinction of being the first hardware crypto wallet, setting the stage for secure non-custodial wallet solutions. Its reputation in the industry is rock-solid, making it a trusted choice for many.

- Offline Storage and Backup: Trezor offers robust cold storage options, allowing you to securely store your crypto assets offline. This eliminates the risks associated with online storage and potential hacking attempts. The wallet also provides offline backup options, ensuring you can recover your assets effortlessly.

- Wide Range of Supported Assets: Trezor isn’t limited to just Bitcoin or Ethereum. It supports over 1,456 crypto assets, offering a broad spectrum for portfolio management. This includes native support for ERC-20 tokens, a feature unique to Trezor hardware wallets.

- Desktop and USB Connectivity: While Trezor may not offer a mobile app, it compensates by providing a secure connection via USB. This adds an extra layer of security, making it a secure non-custodial hardware wallet that’s hard to compromise.

Trezor Models

- Trezor Model T: Priced at $219, it is notable for its large touchscreen, allowing you to enter your seed phrase directly on the device. This eliminates the risk of malware infection from computers. It supports 1,456 crypto assets.

- Trezor Model One: The more affordable option at $69, the Model One was the first hardware wallet and supports over 1,289 cryptocurrencies. It offers a clean design and user-friendly interface but lacks the touchscreen feature of the Model T.

The Drawbacks

Trezor’s firmware updates can be a bit daunting, especially for new users, as they often result in the wallet being wiped clean. However, the offline backup options ensure that you can quickly restore your wallet using your backup phrase.

KeepKey

KeepKey is a product from ShapeShift, known for its seamless in-wallet crypto exchange. Even though it comes with a relatively large display, it is well-designed and compatible with Windows, macOS, and Linux.

Why Choose KeepKey?

- First In-Wallet Crypto Exchange: KeepKey is unique for its in-wallet crypto exchange feature via the native Thorchain integration. This allows you to trade between 7,217 supported crypto assets without needing to move your assets to an external exchange.

- Offline Storage and Backup: KeepKey offers cold storage options, allowing you to securely store your crypto assets offline. This eliminates the risks associated with online storage and potential hacking attempts.

- Desktop and USB Connectivity: While KeepKey may not offer Bluetooth connectivity, it compensates by providing a secure connection via USB. This adds an extra layer of security, making it a secure non-custodial hardware wallet that’s hard to compromise.

KeepKey Model

- Price: $49

- Bluetooth Connectivity: No

- Number of Crypto Assets Supported: 7,217

- User-Friendly Interface: Yes

The Drawbacks

One downside of KeepKey is that the initial setup might be too daunting for beginners and also there is limited number of crypto assets that can be stored at any one time. However, its unique in-wallet exchange feature and advanced security features make it a compelling choice.

SafePal

SafePal is a unique offering in the hardware cryptocurrency wallet space, combining both online and offline elements for a comprehensive crypto management solution. It’s a Binance-backed wallet, adding an extra layer of credibility.

Why Choose SafePal?

- Hybrid Wallet Experience: SafePal offers the best of both worlds, with a hardware device for secure offline storage and software products like a mobile app and browser extension for convenient online interactions.

- Advanced Security Suite: Their SafePal S1 hardware wallet comes with many security features, including EAL5+ certified security, multiple security-sensor layers, a true RNG, and a self-destruct mechanism in case of malware attacks.

- Community Support: SafePal offers 24/7 community support, to create a friendly user experience. This is a unique feature not commonly found in hardware wallets.

- Extensive Asset and Blockchain Support: SafePal supports over 30,000 crypto assets and 54 blockchains, including storing NFT assets on the ERC-20 chain. This makes it one of the most versatile wallets in terms of asset support.

SafePal S1 Model

- Price: $49.99

- Bluetooth Connectivity: No

- Number of Crypto Assets Supported: Over 30,000

- User-Friendly Interface: Yes

The Drawbacks

The SafePal S1 lacks Bluetooth connectivity, which could be a downside for those looking for wireless convenience. Additionally, its hybrid nature might not appeal to those looking for a purely offline solution.

Best Practices: How to Use Your Non-Custodial Wallets

When you opt for a non-custodial wallet, you’re essentially becoming your own bank. With great power comes great responsibility, and in the crypto world, that means taking extra precautions to secure your digital assets. Here’s a rundown of best practices to help you navigate the world of non-custodial wallets safely.

Double Down with Two-Factor Authentication (2FA)

If your wallet offers 2FA, enable it without a second thought. This adds an extra layer of security that can make all the difference in safeguarding your assets.

Backup, Backup, Backup

Always have a backup of your wallet’s seed phrase. Store this backup in a secure location like a safe deposit box. This is your lifeline if you ever lose access to your wallet.

Guard Your Private Keys Like a Treasure

Your private keys are the gateway to your digital wealth. Keep them safe, secure, and offline. Sharing is not caring in this case; never share your private keys with anyone.

Be a Phishing Detective

Always be on the lookout for phishing attempts. If something smells fishy, it probably is. Never divulge your private keys or seed phrase based on an email or social media request.

Fortify with Strong Passwords

When setting up your wallet, go for a password that’s as strong as a vault. Use a mix of characters, numbers, and symbols. A password manager can be your best friend here.

Stay Updated

Keep your wallet software up-to-date to benefit from the latest security patches and features. Outdated software is a low-hanging fruit for hackers.

Only Use Trusted Network

Access your wallet only from trusted networks. Public Wi-Fi is a playground for hackers. If you have to use a public network, a VPN can offer an extra layer of security.

Invest in a Hardware Wallet

If you’re dealing with a substantial amount of crypto, a hardware wallet is a wise investment. It’s like a safe within a safe, keeping your private keys offline.

Keep an Eye Out

Regularly monitor your wallet’s activity. If something looks off, act immediately to secure your assets.

Remember, the security of your non-custodial wallet is in your hands. By following these best practices, you’re not just securing your assets; you’re investing in peace of mind.

Pros and Cons of a Non-Custodial Wallet?

When it comes to managing your cryptocurrency, choosing the right type of wallet is crucial. Non-custodial wallets offer a level of freedom and control that’s hard to match, but they also come with their own set of challenges. Let’s break down the pros and cons to help you make an informed decision.

| Aspect |

Pros |

Cons |

| Control Over Keys |

Complete control over your private keys, ensuring that you are the sole owner of your assets. |

Losing or incorrectly recording your seed phrase means you can never access your funds again. |

| Ease of Use |

Fast and easy to create new wallets without any bureaucratic hurdles. |

More technical know-how is needed to use advanced features, making it challenging for beginners. |

| Security |

Funds are secure and won’t be impacted in cases of exchange hacks. |

Impossible to recover digital assets if you lose your private keys and/or recovery phrases. |

| Privacy |

No KYC (Know Your Customer) or AML (Anti-Money Laundering) processes are necessary for creating or storing your wallet. |

– |

| Functionality |

Ability to interact with native DeFi applications and access more advanced functions than custodial services offer. |

– |

By weighing these pros and cons, you can better understand if a non-custodial wallet aligns with your crypto management needs. Whether you value complete control or are wary of the technical challenges, the choice ultimately lies with you.

Frequently Asked Questions

What is a Non-Custodial Wallet?

A non-custodial wallet, often called a self-custodial wallet, is a cryptocurrency wallet where you have full control over your assets. Simply put, you’re the only one who can access your private keys or seed phrase, making you the sole gatekeeper of your crypto funds.

What is the Difference Between a Custodial and a Non-Custodial Wallet?

The key difference boils down to control over private keys. In a custodial wallet, a third-party service holds your private keys, essentially having custody over your funds. With a non-custodial wallet, you’re in the driver’s seat, holding your private keys and full control over your crypto assets.

Is Coinbase Wallet a Non-Custodial Wallet?

Absolutely, Coinbase Wallet is non-custodial. This means you’re the only one with access to your private keys, giving you full authority over your funds.

Is Trust Wallet Non-custodial?

Yes, Trust Wallet is a non-custodial wallet. It empowers you with complete control over your private keys and, by extension, your crypto assets.

Is MetaMask Non-Custodial?

Indeed, MetaMask is a non-custodial wallet. It’s designed to give you full control over your private keys, allowing you to manage your cryptocurrencies on your terms.

What Wallets are Non-custodial?

Some of the non-custodial wallets we discussed in this article include Trezor, Ledger, SafePal, and MetaMask, among others.

Is CashApp a Non-Custodial Wallet?

No, CashApp is a custodial solution. This means platforms like CashApp, Robinhood, Coinbase, Venmo, PayPal, and Binance hold your private keys for you.

What are the Best Non-Custodial Wallets?

Our top pick for the best non-custodial mobile wallet is MetaMask. It offers a blend of user-friendly features and robust security measures, making it a go-to choice for many crypto enthusiasts.