So you want to know the differences of Bitcoin vs Altcoins.

You’ve heard about Bitcoin, the digital currency that started it all? But what about the altcoins, those other cryptocurrencies that share the spotlight with Bitcoin in the diverse world of digital assets?

These altcoins are part of a vibrant landscape from Ethereum and Litecoin (LTC) to Bitcoin Cash. Like Bitcoin, they rely on blockchain technology for security, ensuring a transparent public ledger of transactions. Whether you’re curious about how to acquire BTC or explore various altcoins, understanding the technology and principles behind them is key.

It’s not just about market trends or tracking price fluctuations; it’s about grasping the decentralized nature of these digital currencies, the innovative technologies behind smart contracts, and their broader role in today’s economy.

So, what sets Bitcoin apart from these altcoins, and why should you care? Whether you’re a curious observer or someone eager to understand the underlying technology, this guide will educate you about the fascinating world of Bitcoin vs altcoins.

Join us as we unravel the mysteries, explore the opportunities, and delve into the technology reshaping how we think about money and value.

Bitcoin – The Pioneer

Bitcoin is the name that started it all. Created by the enigmatic Satoshi Nakamoto in 2009, Bitcoin introduced the world to decentralized finance, pioneering blockchain technology.

At the heart of Bitcoin is the blockchain, a public ledger that allows transactions without the need for central banks or third parties. A world where everyone has access to this ledger, and every transaction is transparent and secure on the Bitcoin network. That’s what Bitcoin brought to life.

But how does it all work?

Through a process called “mining“, computers use hashing power to solve complex algorithms, creating new digital assets and making them tradable. This innovative technology is fascinating and revolutionary, with a track record of reshaping how we think about money.

What sets Bitcoin apart is its security and anonymity. Thanks to encryption, transactions are validated safely, and with only 21 million coins ever to be created, Bitcoin’s scarcity adds to its value. It’s a digital currency that offers stability in a highly volatile crypto market.

And the innovation doesn’t stop there. The Bitcoin community continually works on improvements like Segregated Witness (SegWit) and the Lightning Network to enhance transaction speed and scalability, addressing perceived limitations while preserving Bitcoin’s core principles. However, this has led to many variations of Bitcoin (Litecoin, Bitcoin Cash, etc.) known as Forks.

Bitcoin’s pioneering role in introducing an alternate form of payment, store of value, its limited supply, and ongoing evolution make it a standout in the cryptocurrency market. It’s more than just a digital asset; it symbolizes a financial revolution with higher risks and potential returns.

Altcoins – The Alternative Coins

The universe of cryptocurrencies doesn’t end with Bitcoin. Altcoins, derived from “alternative” and “coin,” represent various digital currencies offering different features and opportunities.

Like Bitcoin, altcoins are built on blockchain technology. This technology ensures that transactions are irreversible, recorded as blocks on the blockchain, and validated through complex methods like cryptocurrency mining, staking, etc.

But what sets altcoins apart? Many altcoin developers aim to provide unique features distinguishing their coins from Bitcoin and other cryptocurrencies. For instance, some altcoins like Stellar strive to be faster, cheaper, and more energy-efficient. Others, like Dogecoin, have gained popularity through endorsements from well-known figures.

Some altcoins have even moved away from the traditional “proof-of-work” approach used in mining, adopting more efficient processes like “proof-of-stake” and crypto staking. This shift reflects the innovative technologies and higher potential returns that altcoins can offer.

Altcoins exhibit remarkable diversity, each designed to address specific challenges and objectives. Here’s a glimpse into the various categories:

Utility Tokens

Such as Ethereum’s Ether (ETH), these power decentralized applications (dApps), and smart contracts.

Security Tokens

They bridge the digital and physical worlds by representing ownership in assets like real estate.

Stablecoins

Like Tether (USDT), they maintain price stability by pegging their value to traditional fiat currency.

Platform-Based Tokens

Such as Binance Coin (BNB), these fuel operations within specific blockchain ecosystems.

Altcoins are more than just Bitcoin’s alternatives; they are innovative solutions. Some are even forks of Bitcoin, created to overcome its perceived limitations and offer new possibilities in the digital assets space.

From the first altcoins launched in 2011 to the present day, these digital currencies continue to evolve, reflecting the dynamic nature of the crypto market and the endless opportunities.

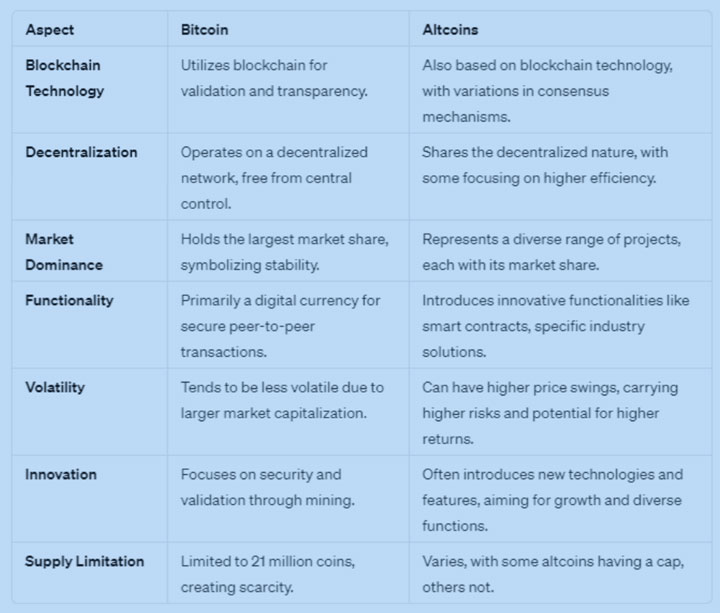

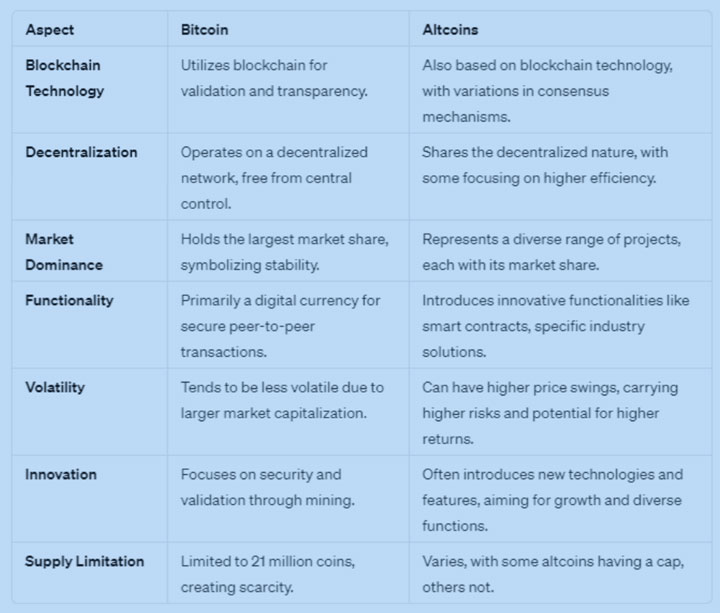

Bitcoin vs Altcoin: A Friendly Face-Off

Bitcoin and altcoins share the stage, each playing a unique role in the cryptocurrency market. While they share common ground in utilizing blockchain technology, their differences are equally intriguing. Let’s explore this friendly face-off, focusing on their similarities, unique features, and how they contribute to the broader crypto market.

Shared Ground: Blockchain and Decentralization

Both Bitcoin and altcoins operate on decentralized networks, using blockchain technology to validate transactions and maintain a public ledger. This decentralized nature ensures no central banks or authorities control these digital currencies, promoting transparency and security.

Market Dominance and Diversity

As the first cryptocurrency, Bitcoin holds a significant market cap, symbolizing stability and trust in the crypto market. Altcoins, however, bring diversity and innovation, each targeting specific challenges and objectives. From smaller market caps to widespread adoption, altcoins complement Bitcoin’s dominance with their unique offerings.

Technology, Functionality, and Innovation

While Bitcoin focuses on being a decentralized digital currency, altcoins often introduce innovative technologies. Ethereum’s smart contracts and Stellar’s energy-efficient blockchain are examples of how altcoins aim to enhance functionality. They explore new horizons, from healthcare to finance, offering solutions beyond mere payment methods.

Volatility

Price fluctuations are common in both Bitcoin and altcoins, reflecting the highly volatile nature of the crypto market. With its track record and larger market capitalization, Bitcoin offers more stability.

Key Features and Characteristics

Bitcoin Features

- Limited Supply: With only 21 million coins, Bitcoin’s scarcity supports its value.

- Security: Mining secures Bitcoin’s blockchain, validating transactions through complex mathematical problems.

- Decentralization: Free from central control, Bitcoin operates on a decentralized network.

Altcoin Features

- Diverse Functions: From healthcare to finance, altcoins cater to various industries, improving upon Bitcoin’s technology.

- Innovation: Altcoins are the playground for new technologies, leading to advancements in the crypto space.

- Potential for Growth: With the right adoption and popularity, some altcoins promise significant price appreciation.

In this friendly face-off, both Bitcoin and altcoins have their strengths and unique offerings. Bitcoin’s stability and recognition contrast with the innovative and diverse nature of altcoins. Together, they form a dynamic ecosystem, each contributing to the broader vision of decentralized finance.

Cryptocurrencies and You: Their Role in Today’s Economy

Cryptocurrencies, once a niche digital currency, have become a transformative force in today’s economy. The crypto market is reshaping traditional financial systems from Bitcoin’s dominance as the first cryptocurrency to the innovative technologies behind various altcoins.

The rise of decentralized finance (DeFi) has opened doors to financial services without the need for central banks or traditional banking systems. Whether you’re exploring investment portfolio options or curious about payment methods, blockchain technology offers transparency, security, and accessibility.

But it’s not just about Bitcoin vs altcoins; the creator economy is thriving with the advent of Non-Fungible Tokens (NFTs). Artists and content creators leverage these unique digital assets to monetize their work, bridging the gap between the digital and physical worlds.

Beyond art and music, NFTs and DeFi influence various industries, from real estate to gaming. The applications are vast, and the growth potential is immense. Smaller market capitalizations in the altcoin market may carry higher risks, but they also present opportunities for innovation and higher potential returns.

The future of cryptocurrencies is as dynamic as the market itself. Continuous innovation, growing acceptance of digital currencies like Bitcoin Cash, and development of more energy-efficient consensus mechanisms indicate a promising future.

Embrace the Future of Finance with CoinPayments

As cryptocurrencies continue to reshape the global financial landscape, CoinPayments emerges as a gateway for businesses and individuals eager to be part of this exciting revolution.

CoinPayments offers a secure payment solution for business owners to start accepting crypto payments, connecting them with a worldwide customer base. Ensuring real-time transactions and industry-low processing fees, accepting Bitcoin, Ethereum, and over 100 altcoins as payment has never been more accessible.

Get Started with CoinPayments today, and step into the future of finance.