Want to know more about blockchain payment processing? You’re at the right place.

In a world where you can order a meal or hail a ride within seconds, it’s surprising that payment systems, especially cross-border payments, haven’t quite caught up. We all want to know how much money we have and be able to use it without jumping through hoops, right? This is where blockchain and distributed ledger technology (DLT) come into play, offering a fresh approach to payment processing.

Blockchain payments are not just a trend but a response to the demand for real-time, transparent financial transactions. With blockchain technology, gone are the days of waiting for money to crawl through multiple intermediaries, racking up fees and delays. Instead, you get fast, secure, and cost-effective payment solutions that put you in control.

Juniper Research predicts that by 2024, blockchain will handle an astounding $4.4 trillion in B2B cross-border payments. That’s a leap from $171 billion in 2019! So, why the surge? It boils down to the need for transparency, traceability, and the elimination of pesky middlemen.

If you’re curious about how blockchain is revolutionizing how we handle money, from individual transactions to global payments, stick around. We’re about to unpack everything you need to know.

What is Blockchain?

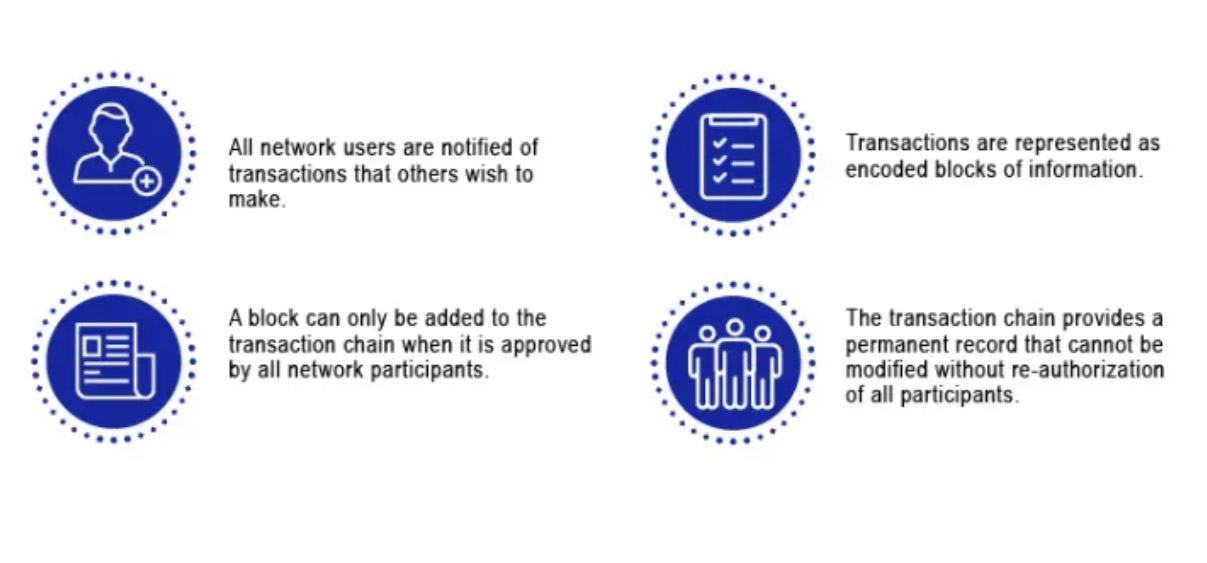

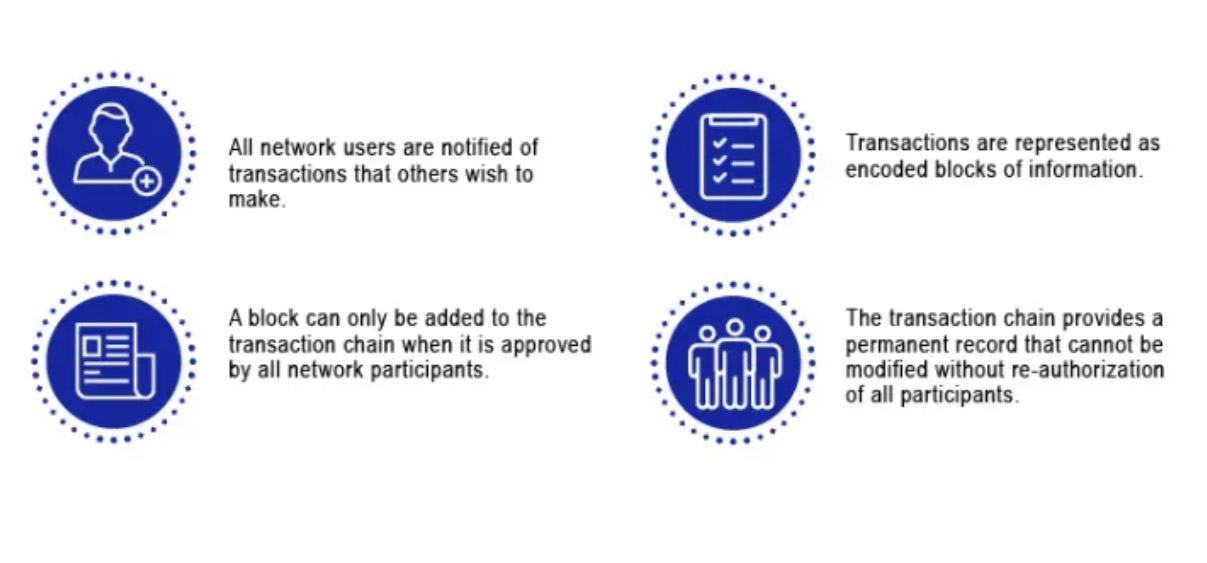

So, you’ve heard the term “blockchain” thrown around, but what does it really mean? Think of blockchain as a digital ledger, but not just any ledger. It’s a continuously growing chain of blocks containing records of various transactions. Once a record is added, it’s there to stay. No edits, no deletions – just a new block if there are any changes. This makes blockchain incredibly secure and transparent, a big deal in payment processing.

You might wonder, “What happens if a computer storing this information crashes?” Well, that’s the beauty of blockchain’s distributed ledger technology. The entire chain is stored on multiple computers, so your data is safe and sound even if one goes down.

But it’s not just about security; it’s also about speed and accuracy. Blockchain technology offers real-time access to transaction details in a business landscape where every second counts. Whether you’re tracking orders, payments, or accounts, everyone on the network shares a single, immutable data source. This not only boosts confidence but also opens doors to new opportunities.

Further Reading: The Complete Blockchain for Beginners Guide: Applications and Technology

What Are Blockchain Payments?

Now that you know about the technology, how does blockchain help with payments? Imagine you’re buying a cup of coffee. Normally, you’d swipe your card, and the bank would act as the middleman to validate the transaction. But what if you could skip the middleman altogether? That’s where blockchain payments come into play.

Banks act as intermediaries in a traditional payment system, authorizing money transactions from the payer to the payee. They validate payments for goods or services, whether it’s domestic or international payments. But with blockchain payments, you can say goodbye to those pesky transaction fees banks charge.

Here’s the best part: blockchain payments are secure and transparent. The technology allows you to track every transaction process step, from start to finish. And don’t worry about privacy; only network participants are notified of the transactions, keeping your identity under wraps.

Further Reading: How did Crypto Payments Evolve to Solve Transaction Problems

How Blockchain Payment Processing Works

Source: PayRetailers

You might be wondering, “How does all this blockchain magic actually work when it comes to processing payments?” Great question! Let’s break it down.

When you initiate a digital currency payment on the blockchain, either you kick it off or smart contracts do it automatically based on certain triggers. This transaction is then sent out to a network of nodes – think of them as mini-servers – that validate the transaction using a consensus protocol. Once it gets the green light, the data is encrypted and stored in a block, complete with a timestamp.

These blocks are then linked in chronological order, forming a distributed ledger. This ledger serves as the go-to source for tracing all payment activities and verifying the identity of users on the blockchain network. And guess what? Everyone on the network has their own copy of this ledger, which automatically updates whenever new data comes in.

Whether you’re an individual, a business, or a financial service provider, you can interact with the blockchain through specialized web or mobile apps. And if you’re wondering about integration, you can easily link your blockchain or crypto payment system with a crypto wallet, accounting software, or even website e.g. your ecommerce sites.

Why Use Blockchain Payments?

You might be wondering, “How does blockchain help with payments?” Let’s unpack why you should consider a blockchain payment solution for your business.

First off, blockchain can establish digital identity verification, meeting Know Your Customer (KYC) guidelines. This is crucial, especially in the finance industry, where compliance is key.

One of the standout features of blockchain payments is the elimination of intermediaries in payment processing. Normally, when you make a payment, especially a cross-border payment, multiple steps and middlemen are involved. Each step often incurs transaction fees. With a blockchain payment solution, the distributed ledger is updated instantly across multiple nodes, streamlining payment processes and reducing costs.

Security is another major plus. Traditional financial transactions stored by financial institutions are susceptible to hacks. But with blockchain’s encrypted distributed ledgers, altering data would require an astronomical amount of computational power and unprecedented access to the network’s ledgers. This makes blockchain payments far more secure than traditional payment methods.

And let’s talk about speed. The time-consuming process of traditional international payments, which can incur an average charge of 3%, is virtually eliminated. Blockchain payments are quick, transparent, and can be tracked from start to finish by network participants. This is particularly beneficial for global transactions.

If you want to accept crypto payments, blockchain technology offers a secure and efficient way. With such benefits, it’s only a matter of time before the widespread adoption of blockchain payment solutions. Being an early adopter could give your business a significant edge in global payments, especially if you’re keen to accept crypto payments.

What Are Blockchain Payment Solutions?

A crypto payment solution is a gateway enabling businesses to accept crypto payments seamlessly. It makes the blockchain payment processing simpler than ever. Imagine having a digital cashier who takes payments and ensures they’re secure, transparent, and irreversible.

Unlike traditional payment systems, which can be subject to reversals and fraud, blockchain payment solutions are immutable. Once a transaction is made and you receive crypto payments, it’s set in stone – or rather, set in a block on the chain. This means you can say goodbye to chargebacks and payment disputes.

What’s even more fascinating is that a blockchain payment system can either integrate with your existing system or be custom-built from the ground up. This flexibility allows businesses to tailor their payment solutions to their specific needs, whether it’s domestic and international payments or cross-border transactions.

Top Blockchain Payment Gateway Platforms

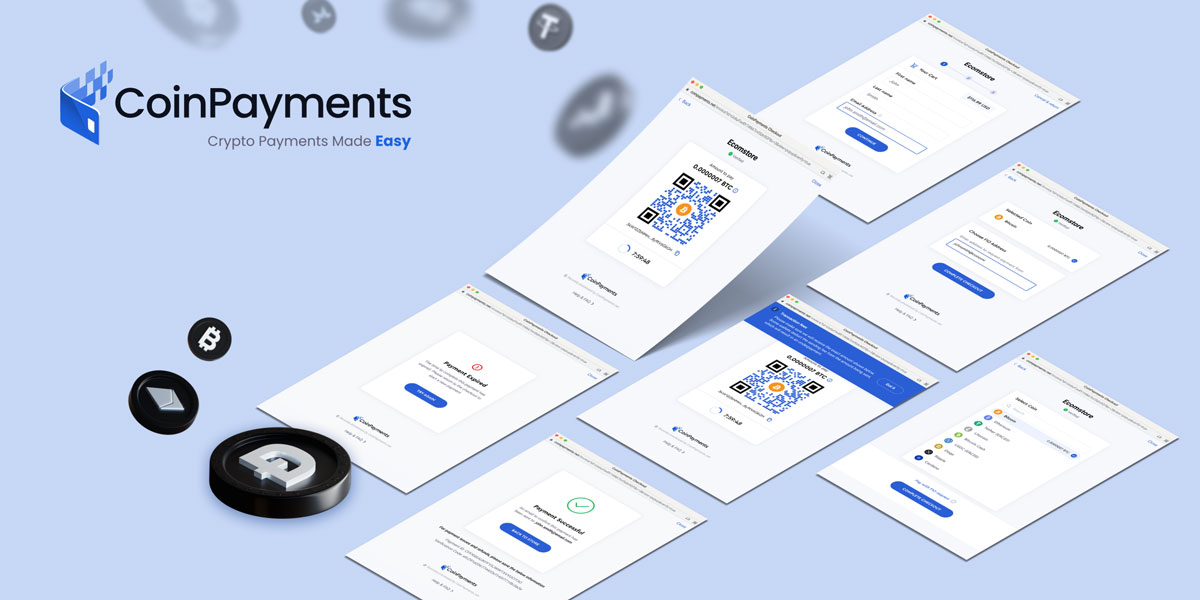

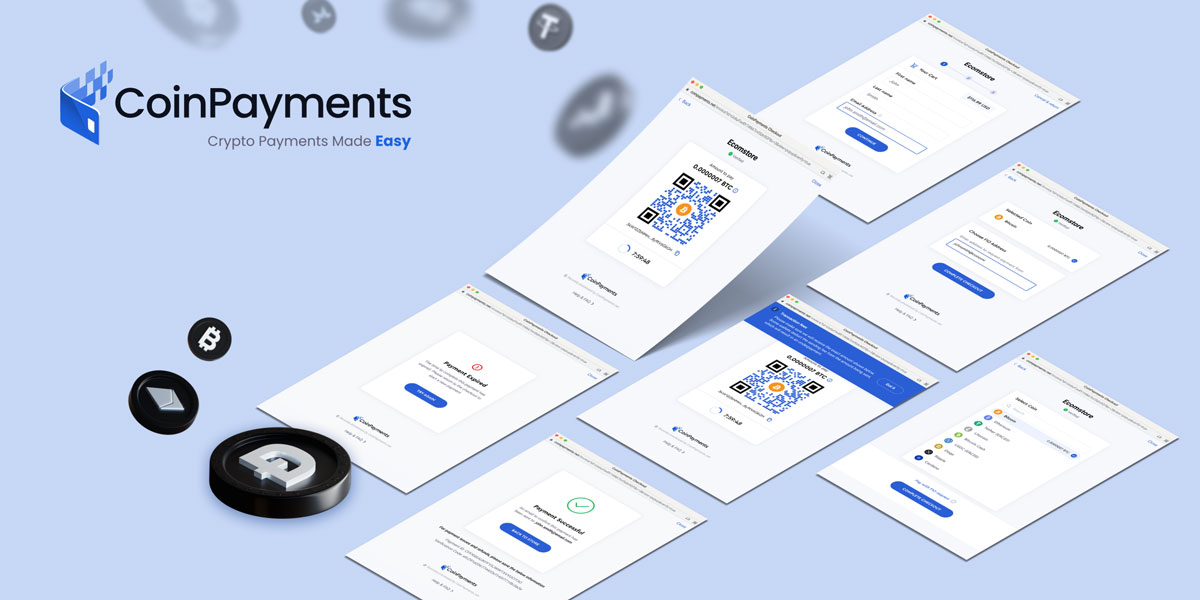

CoinPayments

CoinPayments is a one-stop shop for businesses looking to accept and manage crypto transactions. The platform supports various digital currencies, from Bitcoin and Ethereum to Ripple. With state-of-the-art security features like encrypted data transfer and custodial wallet storage, you can rest assured that your transactions are safe.

CoinPayments Key Features

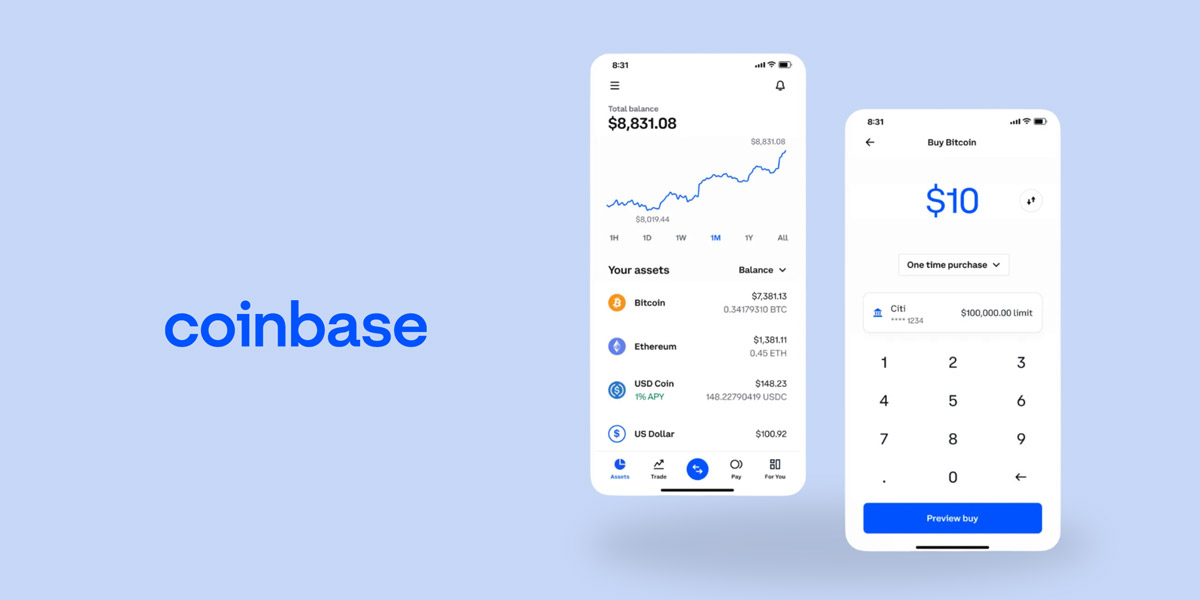

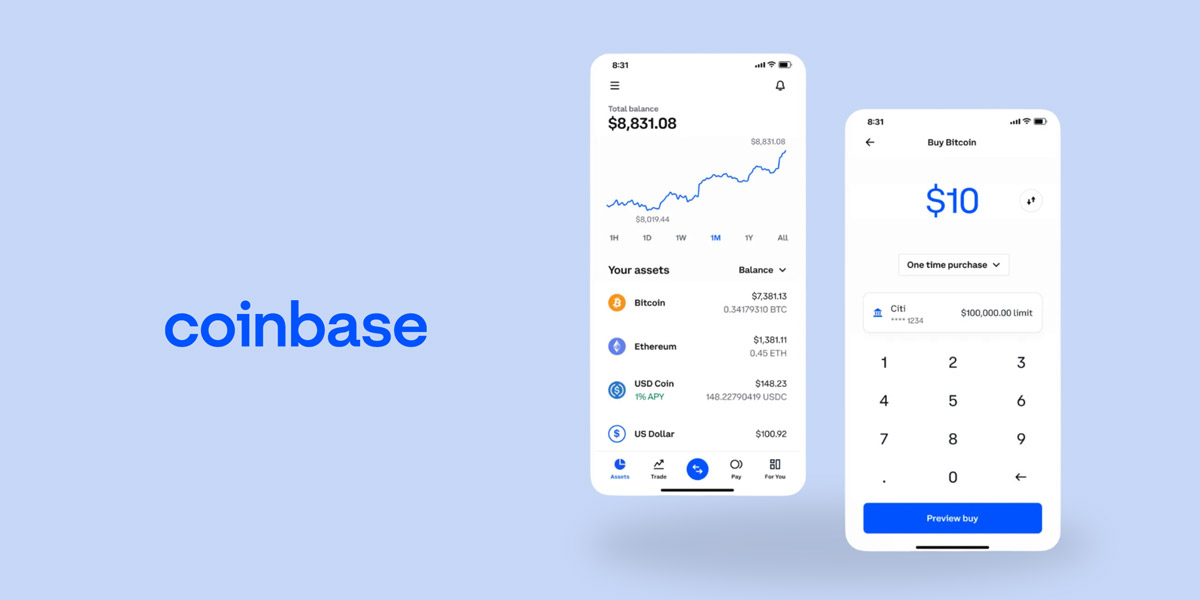

Coinbase Commerce

Coinbase Commerce is a user-friendly platform that allows businesses to accept multiple cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. The platform offers instant payment verification, making the transaction process smooth and efficient.

Coinbase Key Features

- Accepts multiple cryptocurrencies

- Instant payment verification

- Easy-to-follow installation process

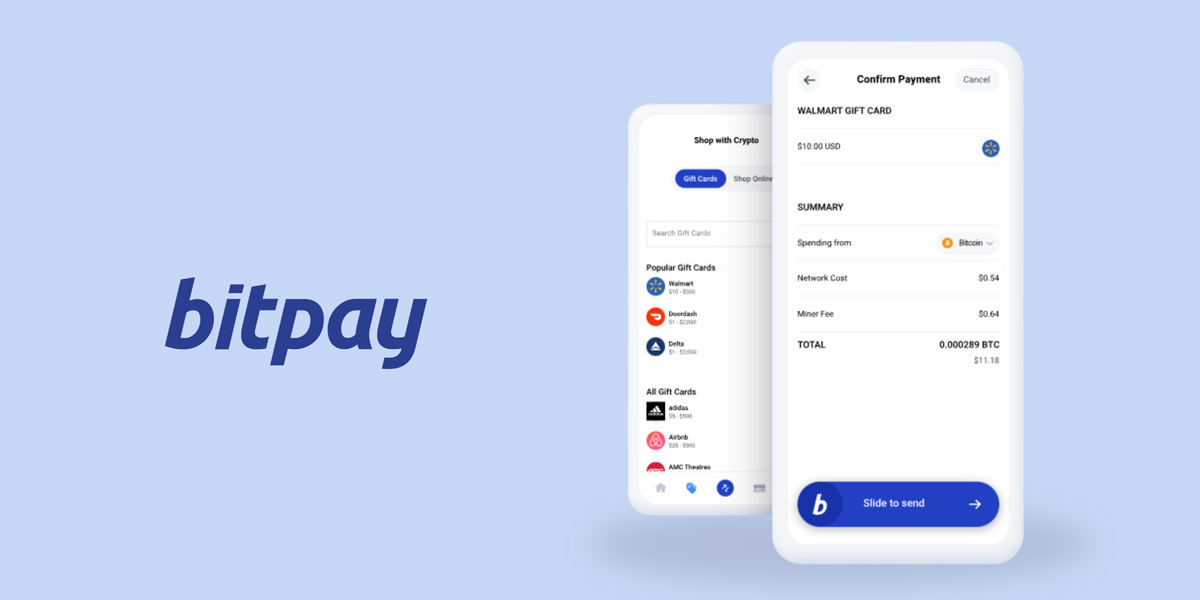

BitPay

BitPay specializes in Bitcoin and Bitcoin Cash transactions. One of its standout features is the ability to convert crypto payments into local fiat currencies, mitigating the volatility risks associated with digital currencies.

BitPay Key Features

- Converts crypto to fiat currency

- User-friendly interface

- Real-time transaction monitoring

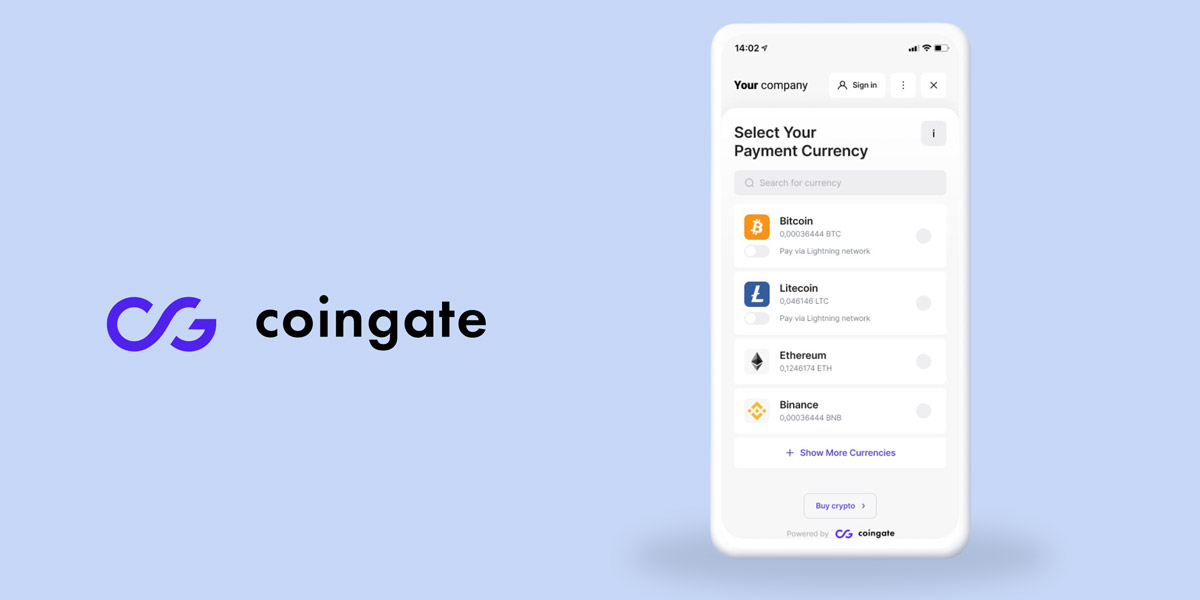

CoinGate

CoinGate is more than just a payment processor; it’s a comprehensive platform for crypto enthusiasts. With a low transaction fee of 1%, it offers a wide range of cryptocurrencies for trading, buying, and selling.

CoinGate Key Features

- Low transaction fee

- Supports multiple cryptocurrencies

- Broad applicability and accessibility

Pros and Cons of Blockchain Payment Systems

Let’s break down the pros and cons to give you a clearer picture.

Pros of Blockchain Payments

Cybersecurity Fortified

One of the biggest perks of blockchain technology is its resilience against cyber-attacks. The decentralized nature of the blockchain network makes it a tough nut to crack, ensuring your digital currency payments are secure.

Technical Failure-Resistant

If a node goes offline, don’t sweat it. The blockchain system is designed to function seamlessly, keeping your payment data intact and ensuring timely outgoing and incoming payments.

Democratic Ownership

No single entity owns the blockchain. Each node in the network maintains its own copy of the digital ledger, making blockchain payment systems affordable and less reliant on a single provider.

Be Your Own Bank

With blockchain, you hold the keys—literally. Your funds are protected by a private key that only you know, giving you full control over your financial transactions.

Real-Time Tracking

The blockchain network offers end-to-end traceability, allowing you to monitor your payments in real-time. This is especially useful for cross-border transactions where traditional systems often lack transparency.

Cons of Blockchain Payments

Lost Keys, Lost Funds

The flip side of having a private key is the risk of losing it. If you forget or lose your key, recovering it—and your digital assets—can be a Herculean task.

Anonymity Concerns

While the anonymity of blockchain payments can be a plus, it’s also a potential downside. The lack of identity verification can sometimes be exploited for illicit activities.

No Room for Error

Accuracy is paramount in the blockchain payment system. If you make an error in the payment data, correcting it isn’t as straightforward as you might hope.

Now that you’re armed with this knowledge, you can decide whether blockchain payment solutions are right for you. The technology offers many benefits, but weighing these against the potential drawbacks is essential.

Unlock the Future of Payments with CoinPayments

Now that you’re familiar with blockchain payment processing, it’s time to embrace it fully.

Since 2013, CoinPayments is trusted by thousands of businesses and individuals in various industries, including high-risk industries like online entertainment and iGaming. As crypto merchant account providers, CoinPayments delivers a reliable and tailored experience to help businesses grow.

Open a free CoinPayments account today and take advantage of the rising popularity of blockchain payment in your business.