There are two popular contenders in online payment services: crypto vs PayPal. Crypto payments, powered by cryptocurrencies like Bitcoin and Ethereum, have gained significant attention. PayPal, a well-established digital payment platform, has been the go-to for many online transactions.

But which method is payment method is better? Using crypto or transacting through a PayPal account? In this article, we’ll compare these payment methods to understand why crypto is emerging as the preferred option for many.

An Overview of Cryptocurrency Payments

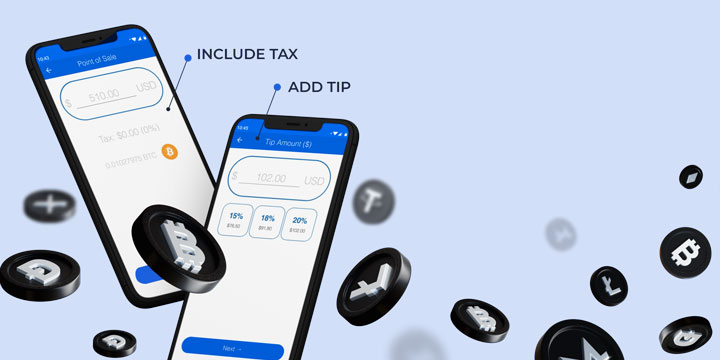

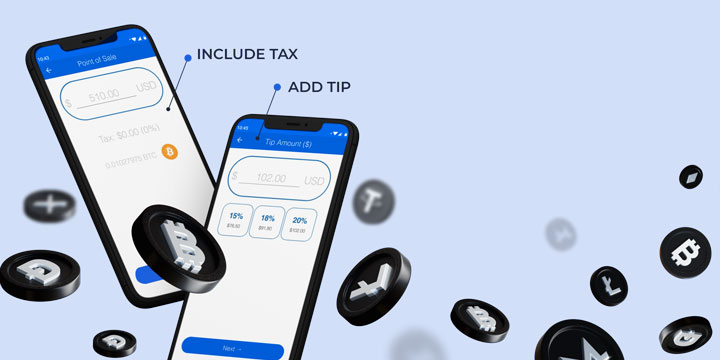

Cryptocurrency payments are platforms allowing people to make payments directly to each other through an online system. This payment system is becoming increasingly popular as more and more merchants and individuals accept cryptocurrencies.

You’ll need a cryptocurrency wallet and crypto assets deposited in your wallet to make a cryptocurrency payment. Once your digital currency is in your wallet, you can transact crypto with merchants or individuals.

Cryptocurrency payments are generally fast, secure and inexpensive, but is this all they offer? Let’s explore the cryptocurrency advantages.

The Benefits of Using Crypto to Settle Your Dues

1. Decentralization and Security

Instead of relying on a central authority, such as a bank, to process transactions, cryptocurrencies enable peer-to-peer transactions directly between individuals or entities. This decentralization eliminates the need for intermediaries, reducing the risk of fraud, censorship, and third-party control over one’s funds.

2. Lower Transaction Fees

Traditional payment processors, including PayPal, often charge a percentage or a fixed fee for each transaction. In contrast, many cryptocurrency transactions involve minimal or negligible fees, especially for smaller transactions, leading to significant cost savings, particularly for businesses handling high transaction volumes.

3. Faster and Borderless Transactions

Crypto payments offer the advantage of near-instantaneous transactions that can be processed within minutes, regardless of the geographic location of the sender and recipient. Traditional payment methods, such as bank or international wire transfers, may take several days to complete. Additionally, crypto payments eliminate the need for currency conversions, making cross-border transactions more efficient and cost-effective.

Having introduced cryptocurrency payments, let’s analyze PayPal and its relevance in online transaction services.

| Comparison Factors |

Crypto Payments |

PayPal |

| Transaction Fees |

Lower or no transaction fees for peer-to-peer transfers |

Higher transaction fees |

| Foreign Exchange Fees |

Favorable rates for international transactions |

Less competitive rates for international transactions |

| Chargebacks |

Irreversible transactions, minimizing fraud risks |

Chargeback protection for buyers but higher risks for sellers |

| Accessibility |

Growing crypto adoption, user-friendly wallets |

Widely accepted, but requires account setup and verification |

| Security |

Blockchain technology and cryptographic encryption |

Buyer and seller protection mechanisms in place |

| Privacy |

Pseudonymous transactions, enhanced privacy |

Personal information required for transactions |

Crypto vs PayPal Summary

Introduction to PayPal as a Digital Payment Platform

PayPal, founded in 1998, is an online payment platform enabling individuals and businesses to send and receive money securely over the internet. With over 400 million active user accounts worldwide, it has become a trusted and widely recognized payment solution.

Let’s explore the features making PayPal a household name in the digital payment world.

Attractive Features and Functionalities

PayPal offers various options catering to different user needs.

Sending and Receiving Money

Whether you split a bill with friends, pay for goods and services or receive payments for your online business, PayPal ensures the process is convenient.

Linking Bank Accounts and Cards

PayPal allows users to link their bank accounts or credit/debit cards to their PayPal accounts. This integration enables quick and easy transactions, as users can choose their preferred funding source without entering their payment details repeatedly.

PayPal Wallet

The PayPal wallet serves as a digital hub for managing your money. It provides a centralized location to store funds, view transaction history, and monitor your account balance.

Mobile App

To cater to the growing trend of mobile payments, PayPal offers a user-friendly mobile app. This app allows users to send and receive money, make online purchases, and manage their accounts.

As with all tools, PayPal has its merits and demerits.

Advantages and Limitations of Using PayPal for Online Transactions

While PayPal offers numerous benefits, it’s crucial to understand its limitations. Let’s start with the perks of using PayPal:

Wide Acceptance

PayPal is accepted by a vast number of online merchants, making it a convenient payment option for various goods and services

Buyer and Seller Protection

PayPal provides buyer and seller protection policies that offer additional security and confidence in transactions, reducing the risk of fraud and disputes

Quick and Secure Transactions

With PayPal, payment processing is instant, allowing for swift transactions. It also incorporates security measures, such as encryption and fraud detection, to safeguard user information and funds

Now, let’s consider the hurdles users face when using PayPal:

Unsustainable Transaction Costs for Most Businesses

PayPal charges high transaction fees, especially for receiving money for goods and services. These fees can vary based on the country and the type of transaction, which may affect the overall cost for businesses and individuals.

Buyer and Seller Protection Challenges

While PayPal offers buyer and seller protection, these mechanisms have their boundaries. Disputes and chargebacks can be complex and time-consuming. And PayPal account holders may be vulnerable to these attacks as not all transactions are covered.

PayPal Account Freezes and Holds

PayPal has the authority to freeze or put holds on user accounts, especially if they suspect fraudulent activity or violations of their terms of service. While this protects users, it can lead to inconvenience and financial stress if legitimate transactions are affected without timely resolution. In select scenarios, users could not access their PayPal balance as they had limited access to their accounts without an explanation from the company. Other PayPal users have also shared their concerns online.

Security Breaches and Phishing Attacks

PayPal is susceptible to security breaches and phishing attacks like any online platform. Hackers may exploit your funds and data by accessing your PayPal account information.

In the next section, we’ll compare the costs associated with crypto payments and PayPal, shedding light on the potential savings and advantages of using cryptocurrencies.

Cost Value Analysis of Crypto Payments Vs PayPal

All businesses consider the expected expenditure before using any service. It’s no different with online payments. Let’s review how crypto payments stack up against PayPal in transaction fees, foreign exchange fees and chargebacks & fraud protection.

A Detailed Comparison of Fees Charged by Crypto Platforms and PayPal

Transaction fees can reduce your profits, especially for businesses processing large transaction volumes. In this aspect, crypto payments have a clear advantage. On average, crypto platforms charge around 1% for transactions, significantly lower than PayPal’s fees.

For instance, PayPal’s transaction fees typically range from 2.2% to 3.5%. If you’re running a business and processing a substantial volume of payments, the costs can quickly add up, impacting your bottom line.

Going Global without Breaking the Bank

Taking your business international involves various preparations, including selecting a suitable transaction service. Crypto payments and PayPal handle these transactions differently. So, what would you use to grow your business beyond your local area? A foreign bank account? Wire transfers?

In handling foreign exchange fees, crypto payments have a potential advantage. Cryptocurrencies have no ties to any specific country or currency, meaning exchanging one cryptocurrency for another or using a cryptocurrency for international transactions can be more cost-effective than PayPal.

Conversely, PayPal charges a foreign exchange fee for converting currencies during international transactions. The exact cost varies and impacts the total amount you receive or pay when conducting business across borders.

What does this mean? Due to high conversion costs, you’ll have a lower PayPal balance than the payment received.

Let’s also consider protection for your funds.

Ensuring Peace of Mind with Protection from Chargeback Fraud

Chargebacks and fraud are concerns for any business accepting payments. It’s crucial to have robust mechanisms in place to address these issues. Here’s how crypto payments and PayPal handle chargebacks and fraud protection.

With crypto payments, the decentralized nature of cryptocurrencies restricts and prevents chargebacks. Once a crypto transaction is complete, it is typically irreversible, reducing the risk of fraudulent chargebacks. While this can provide security for merchants, it’s essential to consider the implications for customer protection.

In contrast, PayPal offers a chargeback mechanism providing buyers with more protection against fraud or unsatisfactory transactions. If a customer raises a dispute, PayPal will investigate. If deemed necessary, facilitate a chargeback to protect the buyer. This feature benefits buyers, but merchants may face a higher risk of chargebacks.

Aside from your funds, cybercriminals are known to target your data. So, how do both payment systems handle user data?

Comparing the Anonymity of Crypto Vs PayPal

Cryptocurrencies offer a unique advantage – anonymity. Crypto payments can be conducted without revealing personal information, ensuring high-level privacy for users. Wallet addresses, random strings of characters, identify transactions instead of personally identifiable information.

And how does PayPal handle privacy?

PayPal requires users to provide personal information, such as their name, address and bank details. While PayPal has privacy measures in place, it still collects and stores this information, which may raise concerns for individuals who value their privacy.

Both cryptocurrencies and PayPal prioritize security and privacy. While cryptocurrencies leverage blockchain technology and encryption to ensure secure transactions and anonymity, PayPal provides centralized security measures and buyer and seller protection policies. The central source of protection can prove disastrous in case of a breach of PayPal’s systems.

Then, what’s the future of online payments?

Predictions in the Dynamic Online Payment Ecosystem

Among the most exciting trends is the increasing acceptance of cryptocurrencies by major retailers and online platforms. Companies like Microsoft, Tesla and Shopify have embraced crypto as a payment option, paving the way for broader adoption.

Additionally, there are ongoing efforts to improve the scalability and efficiency of blockchain networks. Solutions such as layer-two protocols and off-chain transactions aim to address the limitations of existing cryptocurrencies, making them more practical for everyday use. These advancements could lead to faster and cheaper crypto payments, further fueling their popularity.

PayPal’s Response to the Rise of Cryptocurrencies

In late 2020, PayPal announced its support for buying, selling, and holding cryptocurrencies (services provided by most crypto exchanges) on its platform, opening the door for millions of users to enter the crypto market. Despite the positive step, PayPal has an uphill battle with established cryptocurrency gateway services which provide crypto-first services to individuals and businesses opting for cryptocurrency payments.

PayPal is not a cryptocurrency exchange in the traditional sense. It does not allow users to buy and sell crypto directly with each other. Instead, PayPal acts as a middleman, allowing users to buy and sell cryptocurrencies with PayPal’s fiat currency. Once you buy cryptocurrency on PayPal, it is held in your account and is not transferrable to another wallet or exchange.

Speculating on the Future of Digital Payments and the Potential Dominance of Crypto

While it is impossible to predict with certainty, the momentum behind crypto suggests it could potentially lead the payment landscape. But could an existing crypto payment service show signs of future market domination?

Could an existing crypto payment service show signs of future market domination?

CoinPayments is a Superior Option to Traditional Payment Methods

CoinPayments, the most trusted cryptocurrency payment partner, signifies the shifting tides from PayPal to crypto-first payment services. With a global presence, anyone can receive payments from any supported region.

Concerning transaction costs, CoinPayments’ industry-low fee starting at 0.5%, ensures businesses retain more from payment transactions. The net effect is low operation costs and increased revenue, encouraging enterprises to explore new markets.

With a dedicated support staff ready to answer queries 24/7, merchants are sure of a smooth experience if they encounter any challenges. Speaking of merchants, CoinPayments currently is trusted by thousands of them since 2013. Merchants can accept more than 100 different coins in their CoinPayments accounts.

Visit the CoinPayments website to learn more.