Stablecoins are often called the backbone of the crypto market, and for good reason. Imagine running a business and wanting to accept crypto payments. The idea sounds great until you consider the price volatility of most cryptocurrencies. That’s where stablecoins come in, offering a stable value that makes it easier for businesses to jump into the crypto world without the rollercoaster ride of price fluctuations.

Different types of stablecoins are differentiated by the kind of collateral that backs them. That said, there’s a type that’s making waves – algorithmic stablecoins. But how do algorithmic stablecoins work? Unlike traditional stablecoins, which are often backed by fiat currency like the U.S. dollar, algorithmic stablecoins use smart contracts and algorithms to maintain price stability. They offer a unique blend of stability and innovation governed by algorithms.

What is an algorithmic stablecoin?

If you’ve ever felt puzzled by the term “algorithmic stablecoin,” you’re not alone. The word “algorithm” might sound like something from a computer science textbook, but it’s quite simple.

An algorithm is just a set of instructions designed to perform a specific task.

Now, let’s kick it up a notch.

You know how platforms like YouTube or Instagram suggest content based on what you’re currently watching or liking? That’s an algorithm at work but a more complex one.

So, what does this have to do with algorithmic stablecoins?

Well, these stablecoins have their own specialized algorithms running on the blockchain. These algorithms maintain the stablecoin’s value by balancing supply and demand. The algorithm’s job is to ensure that an excess supply doesn’t devalue the stablecoin and that too much demand doesn’t inflate its value. It’s like a digital balancing act aimed at maintaining price stability.

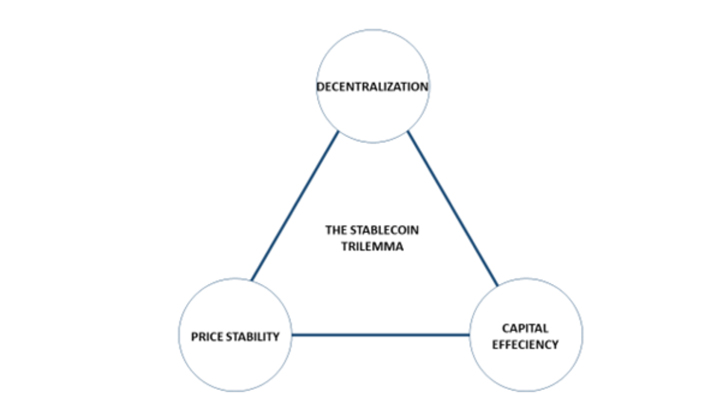

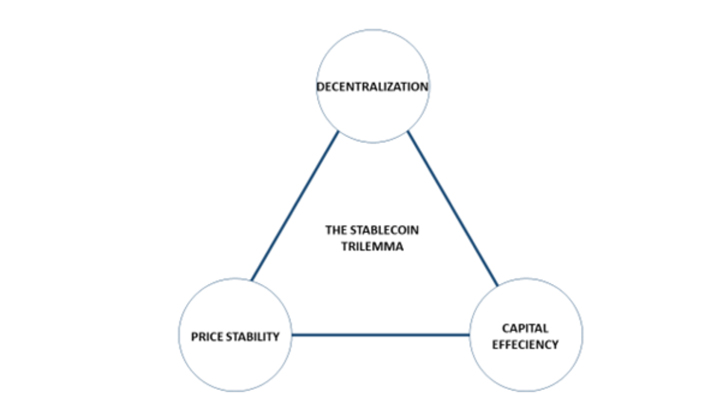

But here’s where it gets even more interesting. Algorithmic stablecoins are designed to solve what’s known as the “stablecoin trilemma.” In essence, they offer a more capital-efficient and decentralized alternative to other stable assets, like crypto-collateralized stablecoins, which often require over-collateralization.

Most algorithmic stablecoins are decentralized ventures governed by Decentralized Autonomous Organizations (DAOs). This means that any changes to how stablecoin operates aren’t decided by a single entity but through governance votes. If you hold some of these stablecoins, you can have a say in managing their managed. It’s democracy in action, right on the blockchain!

Understanding the Stablecoin Trilemma

You might be wondering, what’s this “stablecoin trilemma” all about? Well, it’s a concept that highlights the three main challenges stablecoins face: decentralization, stability, and capital efficiency. Most stable assets can excel in one or two of these areas but struggle with the third.

For instance, fiat-collateralized stablecoins like USD Coin (USDC) are stable and capital efficient but are centralized. On the other hand, crypto-collateralized stablecoins might be decentralized but require over-collateralization, making them less capital-efficient.

This is where algorithmic stablecoins shine. They aim to tackle all three corners of the trilemma. They’re decentralized, governed by smart contracts and DAOs, and don’t require over-collateralization, making them more capital efficient. However, it’s worth noting that they’ve had their own challenges in maintaining peg stability, but that’s a topic for another day.

How do algorithmic stablecoins work?

An algorithmic stablecoin uses smart contracts and algorithms to keep its price stable. But how exactly does this work?

Imagine a seesaw. On one side, you have supply; on the other, you have demand. The algorithm acts like an invisible hand, constantly adjusting the weight on each side to keep the seesaw balanced. If there’s too much supply, the algorithm might initiate a “rebase,” reducing the circulating supply of the stablecoin to bring the price back up. Conversely, if demand is high, the algorithm might mint new tokens to meet the market conditions, preventing the price from skyrocketing.

The beauty of algorithmic stablecoins is that they’re not tied to any fiat currency or collateral. They’re self-sustaining, governed by code and community consensus through governance votes. This makes them incredibly capital-efficient and flexible, adapting to real-time market conditions.

Further Reading: How Do Stablecoins Work and What Are They?

Types of algorithmic stablecoins

There are different types, each with its own unique approach to maintaining price stability. Let’s break them down.

Rebasing Algorithmic Stablecoins

Ever heard of a “rebase”? It’s a term you’ll often come across in the realm of algorithmic stablecoins. Rebasing algorithms adjust the supply of stablecoins based on demand. If the stablecoin’s price exceeds $1, the algorithm increases the supply to decrease the stablecoin price.

If it’s below $1, the supply shrinks, pushing the token price back up.

Ampleforth (AMPL) is a popular algorithmic stablecoin of this type, where the supply changes, but your proportion in the overall supply remains the same.

Seigniorage Algorithmic Stablecoins

Next up, we have seigniorage algorithms. These work with a stablecoin, and a second token often called a seigniorage token. This second token maintains the stablecoin’s peg to $1.

If the stable asset’s price rises above $1, the algorithm burns the seigniorage token to create more stablecoins. If it falls below $1, the stablecoin supply is burned and reduced to create more seigniorage tokens.

Basis Cash is a well-known example, and holding its seigniorage token might even give you governance rights.

Fractional Algorithmic Stablecoins

Last but not least, we have fractional algorithmic stablecoins. These use a mix of collateral, like USDC, and an algorithmic reserve. Frax is a prime example, where users could mint the stablecoin by depositing a combination of USDC and Frax’s own FXS token. This type of stablecoin offers a blend of collateralization and algorithmic magic, making it a versatile option in the stablecoin market.

Risks of algorithmic stablecoins

Alright, let’s talk about the elephant in the room—risks. As intriguing as algorithmic stablecoins are, they come with their own set of challenges.

Peg Stability: A Double-Edged Sword

The stability of an algorithmic stablecoin is only as good as its algorithm. Remember the UST collapse in 2022? That was a wake-up call for many. UST was one of the most popular algorithmic stablecoins in 2022.

LUNA backed UST, and the idea was that if UST’s price fell below $1, you could buy it cheap and redeem it for $1 worth of LUNA. Sounds good, right?

Well, not when everyone starts to doubt the system. The collapse was a domino effect that started with large transactions converting UST to USDC, spiraling from there.

The takeaway?

Peg stability is crucial for investor confidence.

Regulatory Hurdles: The Uncertain Future

The regulatory landscape for algorithmic stablecoins is like walking on thin ice. After the UST debacle, regulatory bodies like the EU pushed for stablecoins to be backed 1:1 by reserves. That’s a big blow to algorithmic stablecoins, which rely solely on algorithms for their stability. So, if you’re considering diving into this space, keep an eye on the ever-changing regulations.

Popular Algorithmic Stablecoins

There was a moment when TerraUSD, an algorithmic stablecoin, climbed to the third spot in market capitalization among all stablecoins. Here are some popular algorithm stablecoins:

Frax

This isn’t just another stablecoin; it’s one of the first algorithmic stablecoins out there, backed by both asset collateralization and algorithms. Built on the Ethereum blockchain, Frax is all about decentralization and scalability.

It aims to be a key player in the DeFi money market, offering services like minting, redeeming, and staking.

What sets Frax apart? It uses two assets: the Frax stablecoin and the Frax Shares utility and governance token. So, if you’re looking for a stablecoin with a governance twist, Frax might be your go-to.

Ampleforth (AMPL)

Next on the list is Ampleforth. This Ethereum-based stablecoin uses a rebasing mechanism to adjust its supply, aiming for that sweet spot of price stability. Unlike fixed-supply cryptocurrencies, Ampleforth’s supply is elastic, making it less susceptible to market volatility. The best part? It’s non-dilutive, meaning you won’t lose your share of the pie even if the supply changes.

Magic Internet Money

Available on popular exchanges, this stablecoin allows anyone to deposit interest-bearing assets as collateral for borrowing.

How do algorithmic stablecoins work? Now you know.

Unlock the Power of Crypto Payments with CoinPayments

CoinPayments is a leading global crypto payment gateway. With support for popular stablecoins and over 100 altcoins, we offer businesses a seamless way to accept crypto payments. Why limit yourself when you can expand your payment options and grow your business globally?

Accept Crypto Now with CoinPayments

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be considered as financial or investment advice. While the author strives to provide accurate and up-to-date information, omissions, errors, or delays in updating the content may exist. Cryptocurrency investments are subject to market risks, including the potential loss of principal. Always conduct your own research and consult a qualified financial advisor before making investment decisions. CoinPayments is not responsible for any financial losses incurred from using the information provided herein.