The crypto market has experienced a volatile journey over its lifetime, with periods of bull and bear runs. Bitcoin, a powerful indicator of cryptocurrency performance, exemplifies the highs and lows of the industry. The recent market changes in Bitcoin’s price and other cryptocurrencies are causing many to ask, “Is crypto in a bear market?”

In this article, we will explore the current state of the crypto market.

What is the Crypto Bear Market?

Before we discuss ‘is crypto in a bear market?’ let’s define what a bear market is. A crypto bear market occurs when cryptocurrency prices fall, and widespread pessimism causes asset value to decline. It is a downward trend in the crypto market.

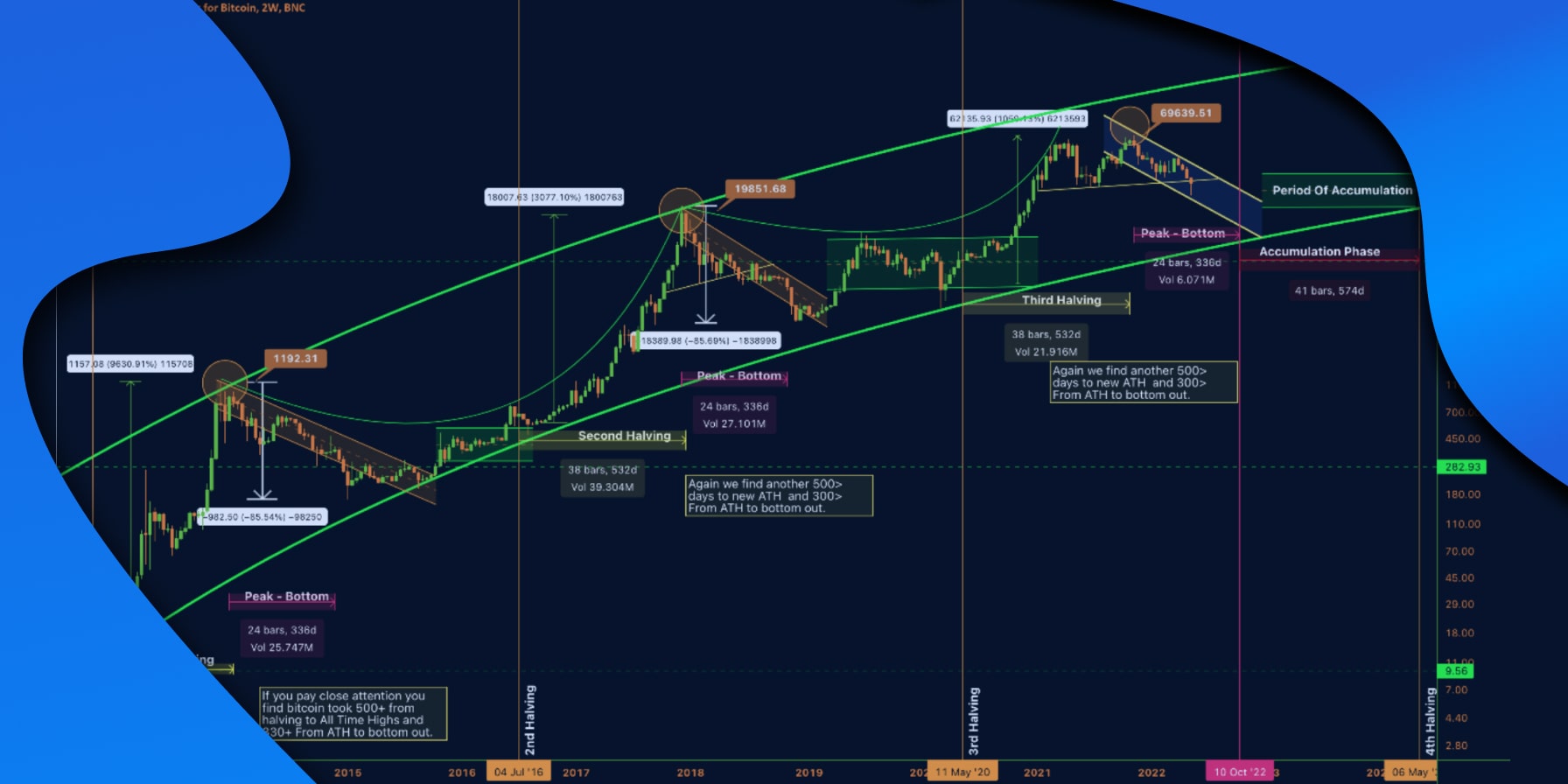

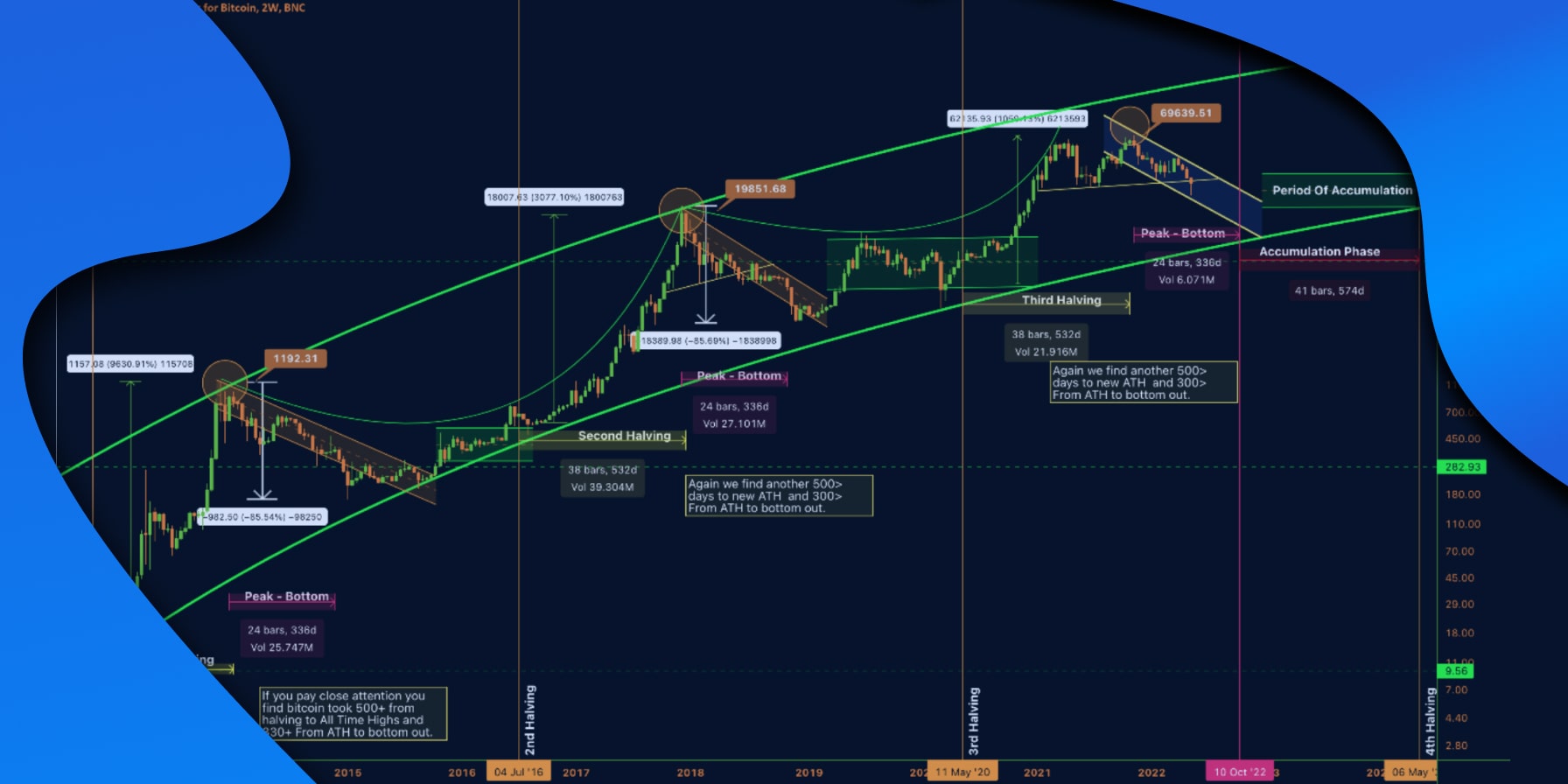

Let’s consider Bitcoin’s price history for context. In late 2017, the price of Bitcoin rose to an all-time high of nearly $20,000, only to fall during the Bitcoin bear market, bottoming out at ~ $3,000 in December 2018.

The market witnessed a similar trend between late 2019 and 2022. Bitcoin’s resurgence saw it set a new all-time high of ~$63,500 before falling to ~$15,000 in the last quarter of 2022. Recently, however, Bitcoin has been gaining ground, having crossed the $23,000 mark at the time of writing.

The Bear Market Cycle

The bear market takes place in four phases:

Phase 1

High prices and positive market sentiment characterize the first phase. Crypto traders liquidate their coins and take their profits as this phase ends.

Phase 2

The second stage features a sharp decline in asset prices and a decline in trading activity. As sentiment declines, the market panics – a behavior known as capitulation.

Phase 3

Speculators enter the market in the third phase, which raises crypto prices and trading volume.

Phase 4

Asset prices continue to decline in the fourth and final phase, but slowly. Bear markets give way to bull markets as low prices and positive news attract new market participants.

The crypto bear market features various characteristics and indications that point to its beginning or end.

What are the Market Indications of a Crypto Bear Market?

Is crypto in a bear market?

A cryptocurrency bear market is an inevitable part of the market cycle and can last for several months or even years. Understanding the indicators of a bear market can help crypto asset holders make informed decisions and protect their portfolios.

A decline in market capitalization

A notable indicator of a bear run is a significant decline in the cryptocurrency market capitalization. A decrease in the total value of all cryptocurrencies is often a sign that the market is losing confidence in an asset.

A decline in crypto trading volume

Another indicator is a decline in trading volume. In a bull market, trading volume increases as more people enter the market. However, in a bear market, trading volume decreases as participants become more cautious and sell their assets.

Decreasing leading cryptocurrency value

Finally, a decline in the value of leading cryptocurrencies, such as Bitcoin and Ethereum, indicates a bear market. If the prices of these coins fall, it is a sign that the market is in a bear phase.

From these characteristics, any cryptocurrency market participant can estimate the current market status.

Are These Actions Reversing the Bear Market?

According to the digital asset data and analytics company CryptoQuant, Bitcoin has begun a new bull market, reversing course after more than a year of unrelenting declines across the cryptocurrency landscape.

Bitcoin has been on the rise. The largest digital asset has increased by almost 40% since the beginning of the year. The recent growth masks the brutal crypto bear market that wiped the increases from the previous bull run. Bitcoin is still only at a third of its all-time high, around $69,000 just over a year ago, at $23,000.

Positive Macroeconomic Factors

The US Bureau of Labour Statistics released an update on January 12, which revealed that annual inflation had decreased to 6.5% in November from 7.1% in October. The report was good news for the cryptocurrency markets, triggering a positive crypto market effect, suggesting the beginning of the end of the crypto bear market.

However, it wasn’t the only positive economic development. A day later, data from the UK Office for National Statistics revealed that the British economy had expanded by 0.1% in November. The information was in addition to news from Germany, where GDP grew by 1.9%, and France, where the economy increased by 0.1% in Q4.

Is Joining the Crypto Markets Worth it Now?

A bear market is a challenging and opportunistic time for cryptocurrency market participants. Market leaders like Bitcoin and Ethereum see their prices fall. The low prices are an advantage for those interested in buying low.

Crypto portfolios will increase in value during a bullish trend, which means low buyers may profit from purchasing during a bear market. But holders suffer significant losses from the price decline.

Cryptocurrency owners can use their assets in various ways despite the market status. Platforms provide options such as staking to grow portfolios, while others facilitate payment services, ensuring holders utilize their crypto.

Crypto Payments Regardless of Market Conditions

Is crypto in a bear market? There’s no definitive answer, only educated predictions based on previous performance. Still, despite an unpredictable bear market, crypto usage is on the rise as people build trust in digital currency for their everyday purchases.

CoinPayments facilitates crypto payments for merchants and businesses globally. With an industry-low transaction fee of 0.5%, thousands of merchants trusting us, and supporting over 100 cryptocurrencies, CoinPayments ensures crypto use through the market cycle. Join CoinPayments for an efficient cryptocurrency payment solution.