When someone searches online for the “best payment gateways for high-risk business,” they’re not just idly browsing. They’re on a quest, a mission to find a solution that allows them to accept payments seamlessly, even when the business landscape seems to be against them due to their “high-risk” label. It’s a journey through a challenging environment, seeking a beacon of hope.

In the past, high-risk businesses were often cornered into a tight spot. Traditional payment processing solutions were out of reach, and the only transactions they could accept were cash and checks. This significantly limited their customer reach and growth potential. But the advent of high-risk merchant accounts like Soar Payments and cryptocurrency merchant accounts like CoinPayments has dramatically changed the game, opening up new avenues for these businesses.

Cryptocurrency is changing the game. As the crypto market continues to evolve and embrace new technologies, an increasing number of high-risk merchants are discovering the potential of incorporating crypto as a payment method. Despite lingering misconceptions about crypto’s reliability and accessibility, the tide is turning, and more businesses are moving away from solely relying on traditional credit and debit cards.

Crypto payment gateways are becoming an essential tool for high-risk businesses. These payment processors not only allow merchants to accept online payments in crypto but also provide a seamless conversion of cryptocurrencies to the fiat currency of their choice. In a competitive world where simplicity is king, these payment technologies are a game-changer, simplifying what could otherwise be a complex process.

What Defines a High-Risk Business?

Some businesses, due to the nature of their operations, the industry they’re in, or the products and services they offer, are labeled as ‘high-risk’. But what exactly does it mean to be a high-risk business?

Being labeled as a high-risk business doesn’t necessarily mean your business is less trustworthy or less viable. Rather, it’s an indication that your business operates in an industry or sector that, statistically, has a higher rate of disputes or chargebacks. This label is more about the potential financial risk associated with your business operations, not a reflection of your business’s worthiness or integrity.

So, what factors contribute to a business being designated as high-risk? Here are some key considerations:

| |

Low-Risk Business |

High-Risk Business |

| Transaction Volume |

Processes less than $20,000 in payments per month and has an average transaction of less than $500. |

Processes over $20,000 in payments per month or has an average transaction of $500 or more. |

| International Payments |

Primarily sells to customers in low-risk countries (U.S., Canada, Japan, Australia, and Europe). |

Sells to customers internationally, especially in countries listed as high-risk for fraud. |

| Merchant History |

Has a long and consistent history of processing transactions. |

New merchant or has minimal history of processing transactions. |

| Industry Risk Level |

Operates in an industry with a low risk of fraud, returns, or chargebacks. |

Operates in an industry considered to be at a higher risk of fraud, returns, or chargebacks, such as subscription-based companies. |

| Credit Score |

Has a high credit score. |

Has a low credit score. |

It’s important to note that being labeled as a high-risk business doesn’t mean you’re doomed to fail. In fact, many successful businesses operate in high-risk industries. The key is understanding the risks, managing them effectively, and finding the right payment solutions that cater to your specific needs. This is where high-risk merchant accounts and cryptocurrency merchant accounts come into play, offering specialized payment solutions for businesses operating in high-risk industries.

What is a Crypto High-Risk Merchant Account?

Cryptocurrency and blockchain technology have been at the forefront of financial innovation for the past decade. What was once a niche interest for a small group of enthusiasts has now become a mainstream topic of conversation among investors, banking experts, and the general public. With an estimated 40% of consumers expressing interest in using cryptocurrency as a form of payment, businesses are increasingly recognizing the need to adapt.

To securely process cryptocurrency payments, businesses need to set up a crypto services merchant account.

But why is this important for high-risk businesses?

Simply put, a crypto merchant account allows high-risk businesses to accept and process cryptocurrency payments, providing an alternative payment solution that can help mitigate some of the risks associated with traditional payment methods.

Opening a crypto services merchant account comes with a host of benefits. Not only does it position your business as forward-thinking and adaptable, but it also offers several practical advantages:

Ease of Integration: Crypto payment gateways can be easily integrated into your existing payment infrastructure, allowing you to accept both traditional and cryptocurrency payments.

Lower Processing Costs: Cryptocurrency transactions typically have lower processing fees compared to traditional credit and debit card transactions.

Simple Cross-Border Transactions: Cryptocurrencies are not bound by geographical borders, making international transactions easier and more efficient.

Easy Refunds: Refunding cryptocurrency payments is a straightforward process, reducing the complexity often associated with traditional payment refunds.

Accept Payments Online and In-Store: With a crypto merchant account, you can accept cryptocurrency payments both online and in physical stores.

When you open a crypto services merchant account, you’re stepping into a world of secure, efficient, and flexible payment solutions. This isn’t just about accepting digital coins, it’s about integrating a system that simplifies cross-border transactions, lowers processing costs, and provides easy refunds.

One of the key features of a crypto merchant account is the crypto payment gateway. This technology uses blockchain to verify all transactions, cross-checking data among multiple servers to ensure legitimacy before sending a final confirmation. This level of security is particularly crucial for high-risk businesses, where the risk of fraud and chargebacks is higher.

While there are many crypto payment gateways available, some like CoinPayments, have made a name for themselves in the industry by offering features tailored to the needs of high-risk businesses. But more on that later.

In essence, a crypto high-risk merchant account is more than just a payment processor; it’s a comprehensive solution designed to navigate the unique challenges of high-risk payment. In the next section, we’ll explore some of the best payment gateways for high-risk businesses category.

The Top 5 Best Payment Gateways for High-Risk Businesses

1. CoinPayments

CoinPayments boasts a significant presence in the crypto payment processing industry and is trusted by thousands of businesses and individuals since 2013. CoinPayments supports over 100 cryptocurrencies for payments, making it a versatile solution for businesses looking to accept crypto payments.

With CoinPayments, high-risk businesses can integrate their API, plugins, and payment buttons to accept crypto payments, providing a wide range of payment options for their customers. This flexibility can help high-risk businesses attract a broader customer base and increase their revenue.

Key Features

- CoinPayments allows businesses to accept payments from anywhere in the world in real time, expanding their customer reach.

- Businesses have the option to convert their crypto payments into fiat currency, providing flexibility in managing their finances.

- CoinPayments custodial wallet supports over 2,000 cryptocurrencies, all manageable from a single platform.

- To protect merchants from the volatility of cryptocurrencies, CoinPayments offers an auto coin conversion feature.

- For added security, users can safeguard their coins in the CoinPayments vault and lock them for as long as they want.

- CoinPayments caters to various high-risk industries, including Forex & CFD Brokers, E-commerce, Marketplaces, iGaming, and more.

2. BitPay

BitPay, established in 2011, is a user-friendly crypto payment gateway that facilitates merchants in accepting a variety of cryptocurrencies and converting BTC into USD for immediate withdrawal. It’s a versatile payment gateway that’s compatible with both web and mobile platforms.

BitPay is particularly beneficial for small businesses, retail shops, and organizations accepting donations worldwide. As the gateway operates on a blockchain, there’s no need to disclose personal transaction details, enhancing privacy and security.

Key Features

- BitPay facilitates bank deposits of crypto across 38 countries, expanding your business reach.

- It supports 15 cryptocurrencies for receiving payments, including giving you a wide range of options.

- BitPay comes with an in-built crypto wallet, providing a secure place to store your digital assets.

- It supports over 40 languages, making it accessible to a global audience.

- The platform provides 2FA (Two-Factor Authentication), adding an extra layer of security to protect users’ funds.

- BitPay provides virtual receipts through email and messages, ensuring transparency in transactions.

3. Coinify

Coinify is a versatile crypto payment gateway that offers a plug-and-play solution for businesses to accept cryptocurrency payments. These payments can be settled in local currency or retained as crypto. Coinify also provides a widget for seamless buying and selling of cryptocurrencies. The platform takes care of liquidity and other backstage operations.

Key Features

- Coinify is used globally by more than 45,000 businesses and payment service providers.

- The platform is designed for easy integration, requiring just a single line of code.

- Coinify provides individual currency trading, payment processing services, and more.

- It offers white-label solutions to help businesses grow their revenue streams.

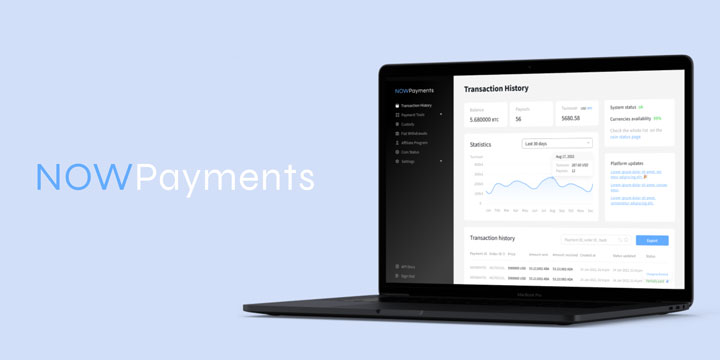

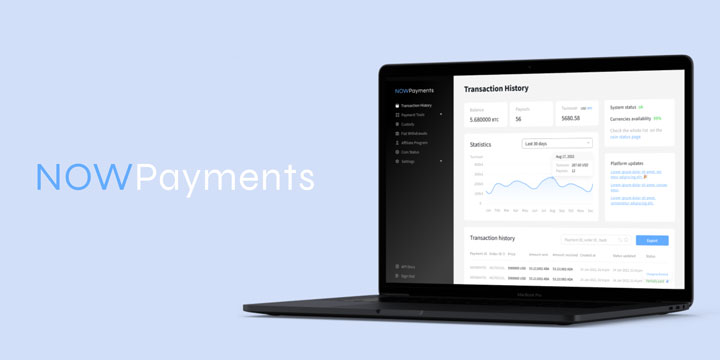

4. NOWPayments

NOWPayments is a non-custodial cryptocurrency payment gateway that features an automatic coin conversion system, allowing customers to pay with any cryptocurrency they choose, while merchants receive the coins they prefer, thanks to NOWPayments’ conversion capabilities.

But NOWPayments offers more than just payment solutions. They also provide a variety of other services tailored to their partners’ needs. These include the ability to accept cryptocurrency donations (including a Twitch button), a mass payout feature, a bespoke solution for casinos, the option to convert to fiat currency, a point-of-sale link, a subscription service, and many other features.

Key Features

- Supports over 160 cryptocurrencies.

- Offers a variety of tools for businesses, including API, invoices, donation widgets, buttons, links, and plugins for various e-commerce platforms.

- Offers multiple options to convert into fiat currency.

- Auto coin conversion protects merchants from volatility losses.

5. B2BinPAY

B2BinPAY provides a comprehensive suite of Bitcoin merchant services to businesses of all sizes. It enables companies to accept cryptocurrency payments, including Bitcoin, on their online platforms. B2BinPAY also offers a corporate crypto wallet.

The company provides a user-friendly, mobile-optimized dashboard for businesses to track transactions. It also features real-time advanced reporting to deliver up-to-the-minute data to merchants. Sellers can accept Bitcoin through various channels provided by B2BinPAY. For enhanced security, the company allows merchants to implement 2-factor authentication.

Key Features

- Supports over 800 cryptocurrencies across major blockchains.

- B2BinPAY can be easily integrated with any mobile app, offering clients a secure way to store coins, stablecoins, and tokens.

- For those wanting to start a Crypto Processing service, B2BinPay provides a comprehensive solution.

- B2BinPay offers solutions for Crypto Brokers, Crypto Exchanges (CEX), Converters, Mobile Wallet Apps, Margin Exchanges, and Multi-Asset Brokers.

The Future of Cryptocurrency for High-Risk Merchants

Cryptocurrencies, especially Bitcoin have been making a significant impact on high-risk businesses. The decentralized nature of cryptocurrencies makes them an attractive option for these businesses. They offer a level of anonymity and security that traditional banking systems can’t provide.

High-risk businesses often face challenges with traditional banking systems, such as account closures and high fees. Cryptocurrencies can help mitigate these issues. They allow businesses to operate without the need for a traditional bank account, reducing the risk of account closures. Additionally, transaction fees for cryptocurrencies are often lower than traditional banking fees.

Cryptocurrencies also provide a level of accessibility that traditional banking systems can’t match. They allow businesses to accept payments from anywhere in the world, opening up new markets and customer bases.

The integration of cryptocurrencies into high-risk businesses is not just a passing trend, but a strategic move towards financial inclusivity and global reach.

Wrapping Up

The array of crypto payment gateway providers today is vast, but finding one that supports high-risk merchant services can be daunting. This guide has provided you with a selection of the best high-risk merchant account providers, each with its unique services and benefits, to help you make an informed decision based on your specific needs.

Crypto, with its inherent advantage of preventing chargebacks, has become increasingly popular among high-risk merchants.

With CoinPayments, high-risk businesses can easily attract a broader customer base and increase their revenue. By opening a merchant account with CoinPayments, you can start leveraging top-notch payment services and position your business for future growth.