The cryptocurrency market has been buzzing with activity, capturing everyone’s attention. If you’re new to this space, you might be overwhelmed by the sheer variety of digital assets available. Among the most talked-about are stablecoins vs altcoins.

While Bitcoin often steals the spotlight, altcoins and stablecoins offer unique features that can make them valuable. Whether you’re a seasoned crypto trader or just dipping your toes into the world of cryptocurrency transactions, understanding the key differences between these two types of digital assets is crucial.

This article will discuss what altcoins and stablecoins are and why they matter. So, let’s get started!

What are Stablecoins?

If you’ve been watching the cryptocurrency market, you’ve probably noticed that price volatility is a big deal. It’s like a rollercoaster ride that not everyone is willing to hop on. Enter stablecoins, the digital assets designed to bring a sense of calm to the often-turbulent crypto market.

Stablecoins are unique because they aim to offer the best of both worlds: the flexibility of cryptocurrencies and the stability of traditional fiat currencies like the US dollar or the British pound. How do they manage to stay so steady in a volatile market? Well, stablecoins are usually pegged to reserved assets, such as fiat currencies or other external assets, to maintain their price stability.

Further Reading: How Do Stablecoins Work and What Are They?

Types of Stablecoins

Let’s unpack the various stablecoins types to help you confidently navigate your crypto adventures.

Algorithm Stablecoins

Algorithmic stablecoins rely on algorithms to maintain stability, potentially without holding traditional reserve assets. These algorithms control the supply of the stablecoin based on predetermined formulas. While reminiscent of central banks’ monetary policies, algorithmic stablecoins distinguish themselves through automated code execution.

Central banks’ policies are backed by their status as issuers of legal tender, but algorithmic stablecoins face challenges during crises. For example, the TerraUSD (UST) algorithmic stablecoin experienced a sharp decline in May 2022, exposing its vulnerability to abrupt market shifts.

Fiat-Backed Stablecoins

Fiat-collateralized stablecoins ensure stability by maintaining reserves of a trusted fiat currency, such as the U.S. dollar. These reserves act as collateral, backing the stablecoin’s value. While other collateral options include precious metals and commodities, most fiat-collateralized stablecoins rely on U.S. dollar reserves.

Managed by independent custodians and subjected to regular audits, stablecoins like Tether (USDT) and TrueUSD (TUSD) maintain a 1:1 peg with the U.S. dollar. As of late July 2023, Tether (USDT) is the third-largest cryptocurrency by market capitalization, with a value surpassing $83 billion.3

Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins take a different approach, leveraging other cryptocurrencies as their collateral. To mitigate the inherent volatility of these reserve cryptocurrencies, these stablecoins are often overcollateralized. This means that the value of the cryptocurrency reserves exceeds the value of the stablecoins issued.

For instance, MakerDAO’s Dai (DAI) stablecoin pegs its value to the U.S. dollar but is backed by a mix of cryptocurrencies, primarily Ethereum (ETH), worth 150% of the circulating DAI stablecoins. This ensures resilience against market fluctuations.

Commodity-Backed Stablecoins

These stablecoins are backed by tangible assets like gold or oil. Owning one is like having a piece of a valuable commodity, offering real market value.

Why Do They Matter?

Stablecoins offer a hedge against crypto market volatility. Unlike most cryptocurrencies, which can see their value swing dramatically daily, stablecoins offer a sense of price stability. This makes them an invaluable tool for those who wish to move money in and out of the crypto market without the rollercoaster ride of price fluctuations.

The essence of stablecoins lies in their ability to maintain a fixed value, often pegged to traditional fiat currencies like the U.S. dollar or the euro. This fixed value enables cryptocurrency investors to convert their volatile assets into stablecoins when they seek a safe haven or prepare for future investments. The stability offered by these digital assets provides a functional utility, especially for those who frequently engage in cryptocurrency transactions.

However, it’s crucial to note that stablecoins have challenges. Despite their promise of stability, some stablecoins have come under scrutiny for not maintaining adequate reserves to back their pegged value. In an industry that’s still largely unregulated, this raises questions about the reliability of certain stablecoins. If a stablecoin fails to uphold its guaranteed price, it could spell disaster for those who rely on it for their financial activities in the crypto market.

In summary, stablecoins play a vital role in smoothing out the inherent volatility of the cryptocurrency market, serving as both a safe haven and a functional utility. Yet, their effectiveness hinges on their ability to maintain a stable value, which is not always guaranteed in the ever-evolving landscape of cryptocurrency.

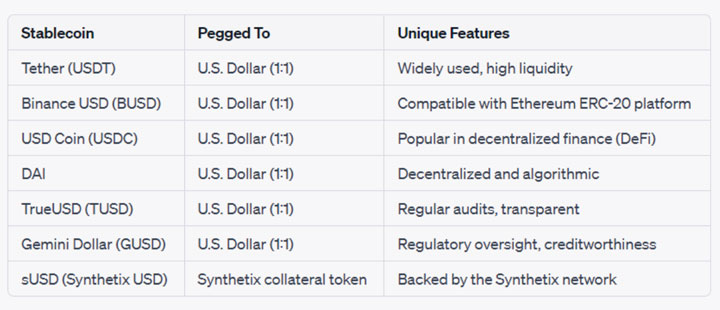

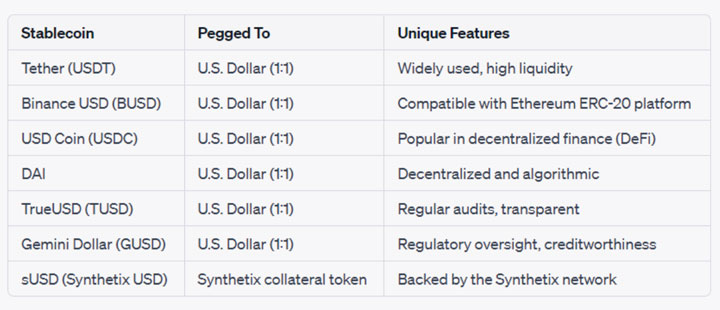

Examples of Stablecoins

Tether (USDT)

Tether is a big player in the stablecoin arena. It’s gained much traction, making it a go-to for traders and investors. What sets Tether apart is its three-pronged approach, focusing on trade utility, which has made it incredibly popular.

Binance USD (BUSD)

Binance USD is another stablecoin that’s making waves. Pegged 1:1 to the U.S. dollar, it’s compatible with the Ethereum ERC-20 platform. This makes it incredibly versatile, allowing it to be used in various use cases without any extra fees for its creation.

USD Coin (USDC)

USD Coin is the official stablecoin of Coinbase and holds a significant position in the world of decentralized finance (DeFi). Integrated with the Ethereum ERC-20 platform, it’s a top choice for those seeking DeFi solutions.

DAI

The DAI stablecoin is a Public Algorithm and decentralized stablecoin that runs on the Ethereum blockchain. Unlike other stablecoins backed by fiat currencies, DAI is backed by other cryptocurrencies. It’s a popular choice for those who prefer a stablecoin not tied to traditional financial systems.

TrueUSD (TUSD)

TrueUSD is another stablecoin that’s fully backed by the U.S. dollar. It offers full transparency and regular audits, making it a reliable choice for those who are cautious about the unregulated nature of the crypto market.

Gemini Dollar (GUSD)

Created by the Gemini cryptocurrency exchange, the Gemini Dollar is a stablecoin that combines the creditworthiness and price stability of the U.S. dollar with blockchain technology. It’s a popular choice for those who want a stablecoin with strong regulatory oversight.

sUSD (Synthetix USD)

sUSD is part of the Synthetix network and is backed by the Synthetix collateral token (SNX). It’s a Crypto-collateralized Stablecoin and an interesting option for those looking to explore synthetic assets within the crypto space.

What are Altcoins?

Bitcoin may be the pioneer and the most well-known cryptocurrency, but the digital asset ecosystem is teeming with various Altcoins. Think Ethereum, Ripple, Litecoin, and many more.

Like Bitcoin, Altcoins rely on blockchain technology for secure and transparent transactions. You’ll need a digital wallet to buy, sell, and hold these alternative cryptocurrencies.

But here’s where it gets interesting: Altcoins are far from mere imitations of Bitcoin. Crafted by forward-thinking developers, these digital assets introduce unique functionalities – be it smart contracts, lightning-fast transaction speeds, or next-level privacy features.

However, caution is key. The Altcoin market is a rollercoaster of price fluctuations, and while blockchain provides a secure foundation, it’s not a fortress. The good news? Security protocols in most Altcoins are agile enough to flag unauthorized activities swiftly.

Types of Altcoins

So, you’ve got a handle on what Altcoins are, but did you know they come in different types? The world of Altcoins is as diverse as it is exciting. Here’s a closer look at the different types of Altcoins available:

Utility Tokens

Utility tokens serve as access keys to specific applications or services within a blockchain ecosystem. These tokens function as the “crypto ticket” for utilizing particular decentralized applications e.g. BAT.

Security Tokens

These tokens act like digital stocks, representing ownership in an external asset or company. Often, they come with the benefit of paying.

Privacy Coins

In an era where privacy is increasingly valued, privacy coins offer enhanced security and anonymity. These coins are designed to obscure the identities of transaction participants, making them a preferred choice for privacy-conscious individuals e.g. Monero.

Platform Tokens

Platform tokens serve as the foundational elements of new blockchain projects. These tokens facilitate the creation of decentralized applications and smart contracts, acting as building blocks for innovative crypto initiatives e.g. SOL.

Exchange Tokens

Unique to specific cryptocurrency exchanges, exchange tokens can offer higher interest rates. These tokens are commonly used to cover transaction fees within their respective trading platforms e.g. CRO.

Why Do They Matter?

Altcoins serve as the backbone of the cryptocurrency industry, offering a more affordable and accessible entry point for a broader audience. They’re not just a side act to Bitcoin; they’re the main stage for groundbreaking blockchain innovations and decentralized applications.

While Bitcoin may be the go-to for many, Altcoins offer a chance to diversify one’s crypto portfolio, providing a hedge against market price volatility. They also bring unique features to the table, from smart contracts to enhanced privacy, catering to various needs and preferences.

As these alternative cryptocurrencies gain popularity, they shape the market dynamics and influence trading patterns, liquidity, and even regulatory focus.

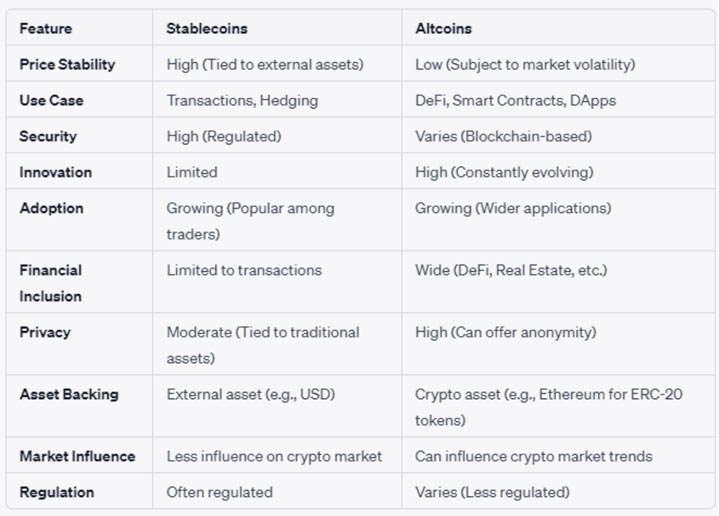

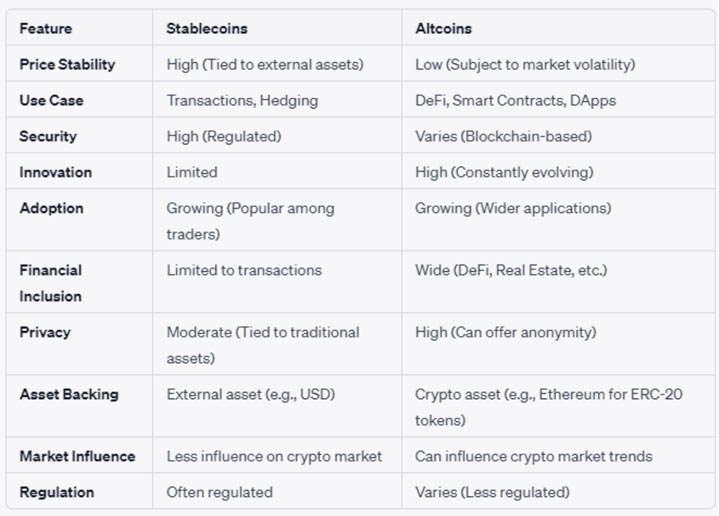

Stablecoins vs Altcoins: What Sets Them Apart and What They Have in Common

Altcoins, like Ethereum, are the backbone of decentralized applications and DeFi projects, driving financial inclusion across various sectors such as healthcare and real estate. Despite their growing value and adoption, they’re subject to crypto market volatility, making them a gamble for short-term traders.

On the flip side, Stablecoins offer a blend of digital security and traditional currency stability. They’re tied to external assets, making them popular for those seeking a stablecoin’s price safeguard against inflation and market price volatility. While they may not offer higher returns like some Altcoins, their price stability makes them a go-to for crypto traders looking to hedge against market fluctuations.

In summary, Altcoins are the innovation engines of the cryptocurrency industry, while Stablecoins serve as a stable medium for transactions, acting as a hedge in a volatile market. Both are essential components of a diversified crypto ecosystem.

Unlock the Power of Crypto Payments with CoinPayments

CoinPayments is a leading global crypto payment gateway. With support for popular stablecoins and over 100 altcoins, we offer businesses a seamless way to accept crypto payments. Why limit yourself when you can expand your payment options and grow your business globally?

Accept Crypto Now with CoinPayments