As more organisations show a keen interest in integrating blockchain into their operations, it’s clear that this technology is not just a fleeting trend. It’s reshaping business strategies and fostering an environment ripe for innovation.

Blockchain has captured the imagination of industries far and wide. This has led numerous companies to adopt blockchain and refine and adapt its capabilities for broader applications.

In this post, we’ll look at the new blockchain-based business models, offering insights into how they pave new avenues for business.

The essence of decentralisation offered by blockchain is transforming our approach to challenges and opportunities. It’s not about displacing traditional business models but enhancing them with a layer of technology that promotes transparency, security, and efficiency. This is why businesses explore and implement blockchain to streamline business processes and set a foundation for future innovation.

So, what’s the catch? Identifying and adopting the right blockchain business model is crucial. Each model offers unique advantages and requires a thoughtful approach to integration. Whether it’s enhancing supply chain management, refining service business models, or improving data storage and exchange, the key lies in understanding how blockchain can be seamlessly woven into existing business frameworks to drive growth and innovation.

Understanding Blockchain

Understanding blockchain technology might seem complex, but it’s fascinating once you understand it. Blockchain is like a digital database everywhere and nowhere simultaneously, belonging to everyone but owned by no one. It’s like a communal diary; everyone can write, but no one can erase a single word.

Blockchain represents a shift in how information is stored, shared, and verified across a distributed network. It’s an immutable, decentralised distributed ledger technology that transcends the traditional boundaries of data management. Unlike conventional databases owned by specific entities or organisations, blockchain operates on a peer-to-peer network, ensuring that no single party has control over the entirety of the data.

A blockchain is a chain of blocks. These blocks are digital records of information tied together with cryptography–ensuring everything stays safe. This whole setup lives across thousands, maybe even millions, of computers all over the globe.

So, what’s the big deal with all these blocks and chains? Well, for starters, it’s all about trust and security. When a transaction happens, it kicks off a process that creates a new block. This new block is then checked and double-checked by countless computers worldwide. Once it gets the green light, it’s added to the chain of blocks, creating a unique record that no one can rewrite or change.

Through all of these, there’s no gatekeeper, no one in charge of the ledger. This freedom from central control makes blockchain a game-changer for business processes and models.

Now, let’s break down three pillars that make blockchain what it is:

Decentralisation: Unlike traditional systems where a single entity (like a bank or government) has control, blockchain operates on a peer-to-peer network. This setup reduces the risks associated with centralised systems, such as data breaches or system failures, by distributing data across numerous nodes.

Each node, or computer, on the network, has a copy of the ledger and can validate transactions independently. This not only enhances security but also democratises data management, putting the power back into the hands of the users.

Immutability: Once something is written down, it’s set in stone (or, in this case, in digital stone). Once a block is added to the chain, altering it would require changing every subsequent block across all ledger copies. This almost impossible task is ensuring each record is permanent and tamper-proof.

Transparency: Though transactions are secure and encrypted, the ledger is public and can be viewed by anyone within the network. This transparency ensures that all transactions are verifiable and traceable, fostering participant trust.

So, there you have it – blockchain technology in a nutshell. Blockchain’s combination of decentralisation, immutability, and transparency offers a new and secure method of conducting transactions, storing data, and building trust in a digital age.

Traditional Business Model

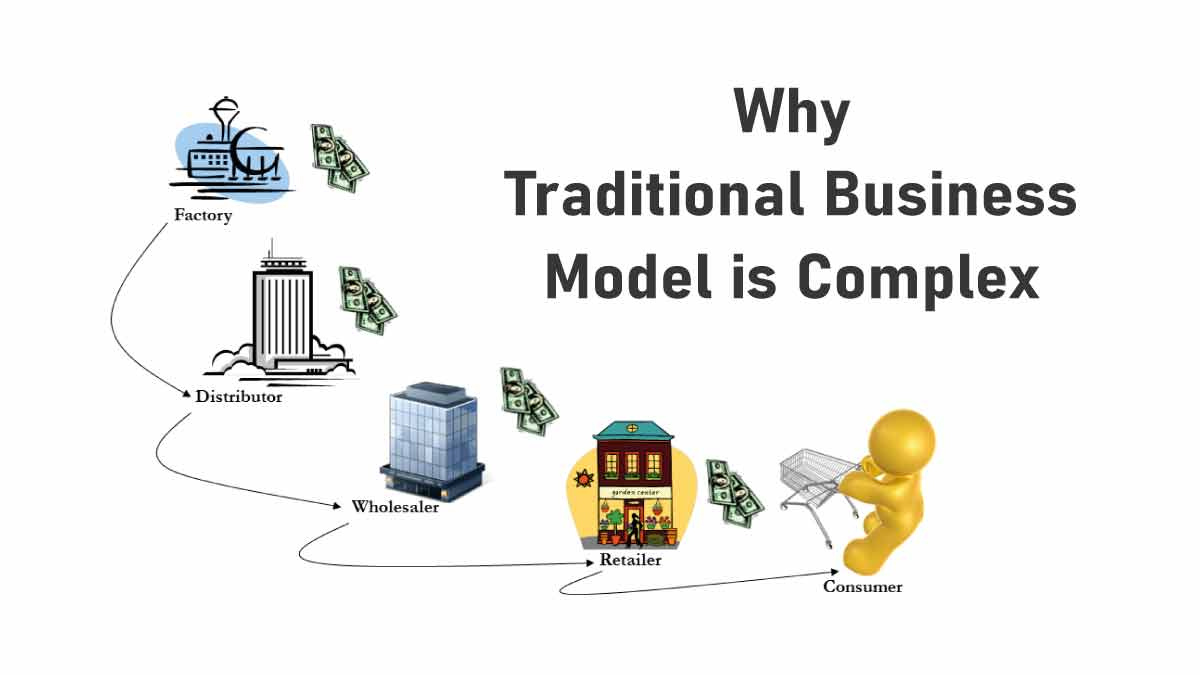

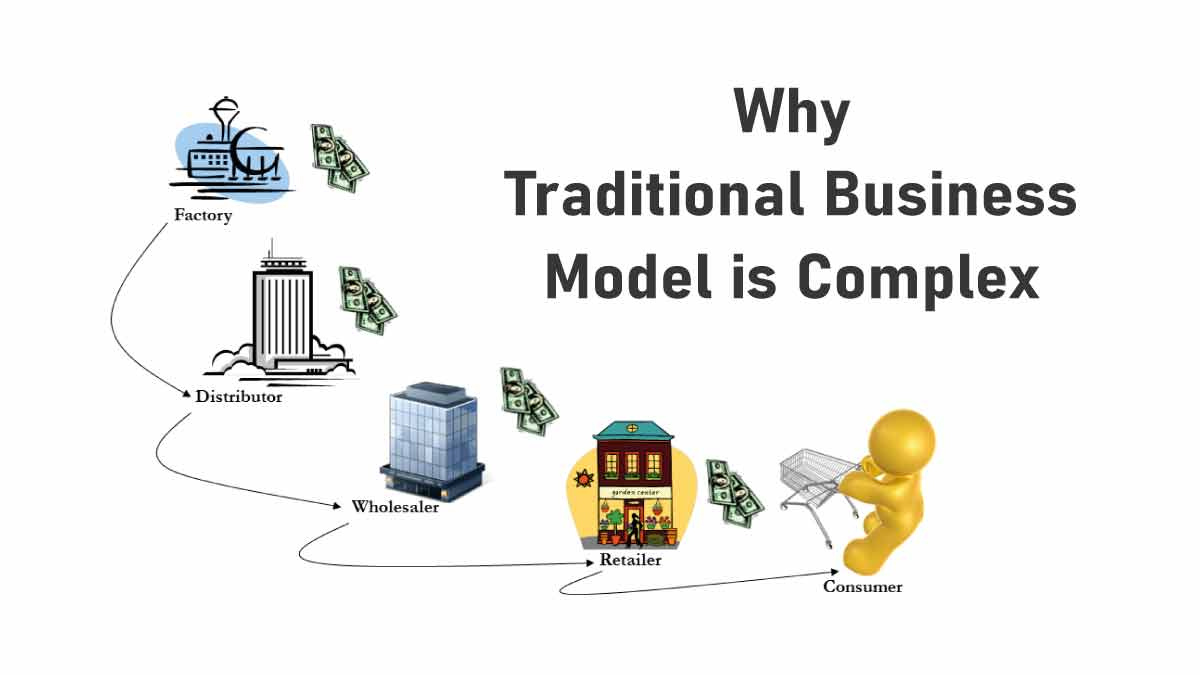

The Traditional business model has long been the backbone of economic activity. This model revolves around a straightforward concept: a company offers goods or services, aiming to generate profit by selling these to consumers at a predetermined price. This price is meticulously calculated to cover production, wages, and overheads, ensuring the business remains viable and profitable.

The traditional business model has a centralised structure. This setup typically involves a hierarchy of ownership and management, from owners or shareholders at the top to employees who manage operations and interact with consumers at the bottom. The flow of decision-making and control is top-down, with strategic decisions made by those at the apex of this pyramid.

Different sectors might adapt this model to fit their unique needs, yet the essence remains consistent across industries. Whether we’re discussing manufacturers, distributors, retailers, or franchises, the central theme is a linear chain of production to consumption. Goods or services are created, marketed, and sold, with profits after expenses either retained within the company or distributed to shareholders as dividends.

Vitalik Buterin, the founder of Ethereum, outlines the traditional business structure by highlighting the roles of these members.

He says:

Investors are essentially part-owners of the business, holding a slice of the company’s virtual property that they can buy into or sell. On the other hand, employees are brought into the fold by investors or other authorised employees, playing a crucial role in the business’s day-to-day operations. Finally, customers are at the receiving end of the business model, purchasing goods or services produced by the company.”

This centralised approach has been the cornerstone of business operations for decades, offering a clear, albeit rigid, framework for economic transactions. Yet, as the digital age propels us forward, the emergence of technologies like blockchain is prompting a reevaluation of traditional models, opening the door to more decentralised, transparent, and equitable methods of conducting business.

The Basics of Blockchain Business Model

The evolution from traditional business models to a blockchain-based business model signifies a shift in how companies conceptualise and execute their business strategies. At the heart of blockchain business models lie the foundational principles of blockchain itself: decentralisation, immutability, and transparency. These characteristics not only redefine the operational aspects of a business but also its very structure and the nature of its transactions.

In contrast to the centralised framework where the hierarchy of ownership and control is well-defined, the blockchain business model thrives on peer-to-peer interactions within a network that’s both reliable and secure. This shift towards decentralisation fundamentally alters the landscape of profit generation and transaction flow, aiming to enhance the benefits for both businesses and their end-users.

A key innovation brought about by this model is the introduction of Decentralised Applications (DApps). DApps operate on a blockchain network, facilitating direct transactions between parties without the need for central authorities or intermediaries. This leap towards self-sufficiency streamlines operations and reimagines traditional stakeholders’ roles within the company. In a blockchain business model, the lines between users, owners, and workers blur, as participants can assume multiple roles within the ecosystem, thanks to the distributive nature of blockchain.

This model also presents a unique approach to generating profits. By retaining a portion of tokens within the ecosystem, companies can secure a source of revenue. This method was popularised through Initial Coin Offerings (ICOs), a form of crowdfunding that gained momentum around 2017. In an ICO, tokens are assigned a predetermined value and sold to investors, allowing early adopters to benefit financially should the project succeed.

The transition to a blockchain business model is a rethinking of how value is created, shared, and sustained within a digital ecosystem. By removing intermediaries, businesses can reduce operational costs and enhance efficiency, increasing profits for investors and more affordable prices for consumers. Moreover, the inherent features of blockchain—its decentralisation, immutability, and transparency—ensure a level of trust and security previously unattainable in conventional models.

In essence, blockchain business models are revolutionary in their approach to combining technology with commerce. They offer a glimpse into a future where businesses operate more democratically, equitably, and efficiently, heralding a new era of corporate structure and economic interaction.

Types of Blockchain Business Models

P2P Blockchain Business Model

The Peer-to-Peer (P2P) blockchain business model is transforming how companies operate, championing direct user interactions without intermediaries, a hallmark of blockchain’s decentralisation. This blockchain model blends the best of Business to Consumer (B2C) and Business to Business (B2B) setups, enhanced by blockchain’s smart contracts, which facilitate secure and flexible transactions between Decentralised Applications (DApps) owners and consumers.

A distinctive aspect of the P2P model is its take on ownership and transactions. It moves beyond traditional payment-for-purchase systems to allow partial ownership, enabling individuals to reclaim items under specific conditions, thereby challenging conventional commerce and ownership norms.

Platforms like the Interplanetary File System (IPFS) and Filecoin are prime examples of the P2P model in action, offering decentralised data storage and sharing solutions. They leverage tokenization, including transaction fees and tokens, to ensure a secure, efficient ecosystem for data management.

With its focus on peer-to-peer connectivity, bolstered by blockchain’s security and transparency, the P2P blockchain business model is setting a new standard for democratic, equitable business practices and fostering innovation across various sectors.

Blockchain as a Service Business Model (BaaS)

The Blockchain as a Service (BaaS) model is emerging as a solution for businesses location to leverage blockchain solutions without the complexities of developing and managing their own blockchain infrastructure. This model allows users to build, manage, and deploy their blockchain applications and smart contracts on a pre-established infrastructure managed by a BaaS provider.

BaaS operates on a subscription basis, offering a secure and efficient environment for businesses to explore blockchain. By paying a monthly fee, users gain access to technical support, regular updates, and the advanced security features inherent to blockchain, such as high-level decentralisation and encryption. This model significantly reduces the barriers to entry for companies looking to adopt blockchain, eliminating the need for extensive resource allocation, bandwidth management, and cybersecurity measures on their part.

Leading the charge in the BaaS space are entities like R3, with its Corda platform focusing on financial services, Microsoft’s collaboration with ConsenSys, and PayStand, among others. These platforms exemplify the potential of BaaS to integrate blockchain technology across various industries, providing the essential infrastructure for companies to innovate and transform their operations.

BaaS stands as a testament to the adaptability and scalability of blockchain, offering a streamlined pathway for businesses to implement blockchain-based solutions. It represents a significant shift towards more accessible, secure, and efficient business processes, underlining the transformative impact of blockchain across the corporate landscape.

Utility Token Business Model

The utility token business model fosters a token-based economy that enhances service delivery. This model revolves around the issuance of blockchain utility tokens (cryptocurrencies), which facilitate transactions and offer clients the chance to partake in revenue sharing or bonuses, enriching the peer-to-peer payment experience.

Utility tokens serve as a bridge between service providers and clients, enabling a more dynamic interaction. The model automates revenue sharing through smart contracts, ensuring a transparent and efficient distribution of earnings between clients and providers. This system is underpinned by decentralised applications (DApps) and custom software-driven programs, which operate within browsers, offering a wide array of smart contract opportunities.

Often referred to as Tokenomics, this business strategy involves retaining a portion of utility tokens within the company while releasing the remainder to the public. This release not only facilitates the functionality of the network but also provides companies with a profit mechanism as the value of their retained utility tokens increases. For users, purchasing these tokens means gaining investment opportunities and becoming integral participants in the marketplace, with the ability to access goods and services, vote on network decisions, reward peers, or even exchange tokens for other cryptocurrencies like Bitcoin.

The utility token model thus represents a significant evolution in how businesses can monetise blockchain, offering a versatile platform for transaction-based services and community engagement. It underscores the potential of blockchain to create more inclusive, participatory economic models where value appreciation benefits both service providers and users, fostering a vibrant and interactive marketplace.

Blockchain-Based Software Products

The blockchain-based software products model is becoming increasingly pivotal for companies aiming to integrate blockchain technology into their existing systems. As the demand for blockchain solutions escalates, both established and emerging businesses are recognising the urgency to adopt this technology to stay competitive.

This model simplifies the adoption process for corporations by providing ready-made blockchain solutions that can be seamlessly integrated into their operations. Blockchain companies that develop these solutions stand to gain significantly, not only through initial sales but also by offering ongoing support post-implementation. This dual revenue stream makes developing and selling blockchain-based software products attractive.

The acquisition of blockchain solutions is often driven by a scarcity of specialised talent in the market. Many companies find the recruitment and training of blockchain experts a challenging and time-consuming task. Purchasing a bespoke blockchain solution offers a direct path to innovation, bypassing the need for extensive talent scouting and development.

One notable example illustrating the potential of this model is the sale of Spotify’s MediaChain, a blockchain solution aimed at resolving issues related to royalties in the music industry. This case highlights how blockchain technology can offer concrete solutions to long-standing industry problems while providing blockchain developers with lucrative opportunities.

For businesses, investing in a blockchain solution and integrating it into their system is a strategic move towards leveraging blockchain’s benefits swiftly and efficiently. This approach accelerates the adoption of blockchain technology across various sectors and stimulates the growth of companies specializing in blockchain solutions, fostering a dynamic ecosystem of innovation and collaboration.

The Future of Blockchain in Business

Looking ahead, it’s clear that blockchain is on the brink of transforming the business landscape in ways we’re just beginning to grasp. Recent trends highlight a growing enthusiasm among companies, big and small, to explore how blockchain and cryptocurrencies can improve their operations.

The beauty of Distributed Ledger Technology (DLT)-based business models lies in their universal appeal. They’re paving the way for businesses across various industries to adopt more open, trustworthy systems while significantly reducing costs. It’s making operations smoother and more transparent than ever before.

When the big names in the business world start to dip their toes into new technological waters, it’s a strong hint that something big is on the horizon. And right now, blockchain business models are quickly becoming a must-have for staying ahead and competitive.

It’s an exciting time to witness how blockchain is moving from the edges to the core of business strategy, offering a solid foundation for secure, efficient, and transparent operations. The leap by major corporations like IBM, JP Morgan, amongst others, into blockchain doesn’t just hint at a trend; it signals a broader shift towards its widespread adoption and integration.

As we look to the future, the potential for blockchain to cut across different sectors is immense. From finance and payments to healthcare and supply chain management, the promise of blockchain to streamline and secure business processes is undeniable.

In essence, the journey into the world of blockchain in business is just getting started. It’s set to redefine how we think about transactions, security, and collaboration on a global scale.

Frequently Asked Questions

How Do Blockchain Businesses Make A Profit?

Blockchain businesses can generate profits through various means, including tokenisation, where tokens are used as a reward system for contributors to the blockchain, and through holding tokens themselves, which can increase in value.

Can Small Businesses Adopt Blockchain Technology?

Yes. Small businesses can adopt blockchain technology, especially through Blockchain as a Service (BaaS) platforms, which provide an accessible way to leverage blockchain without the need for extensive technical expertise or significant upfront investment.

Is Blockchain Technology Only Beneficial For Financial Businesses?

No. While finance was one of the first industries to adopt blockchain, its benefits extend across multiple sectors, including supply chain, healthcare, real estate, and more, by providing enhanced transparency, security, and efficiency.

Are There Any Risks Associated With Blockchain Business Models?

Yes. Risks include technological challenges, regulatory uncertainty, scalability issues, and the potential for fluctuating cryptocurrency values affecting business operations or profits.

Can Blockchain Be Used For Voting Systems?

Yes. Blockchain can be used to create secure, transparent, and tamper-proof voting systems, ensuring the integrity of the voting process and the confidentiality of votes.

How Do Blockchain Businesses Handle Data Privacy?

Blockchain businesses can enhance data privacy through encryption and provide individuals control over their data. However, the public nature of some blockchains means privacy approaches must be carefully designed, often utilising private or consortium blockchains for sensitive data.

How Do Consumers Benefit From Blockchain Business Models?

Consumers can benefit from increased transparency, enhanced security, reduced costs due to eliminating intermediaries, and improved access to services through decentralised applications.

Further Reading:

The Complete Blockchain for Beginners Guide

Private vs Public Blockchain: The Key Differences

Blockchain Layers Explained: Layers 0, 1, and 2

Blockchain Payment Processing: What You Need to Know